Maritime Makeover: The Role for Investors in Decarbonizing Global Shipping

Maritime Makeover

Maritime shipping occupies a central position in the global supply chain: nearly 100,000 commercial vessels move 11 billion tons of goods each year, accounting for about 80% of global trade volume. The associated greenhouse gas emissions add up, and shipping accounts for about 3% of global greenhouse gas emissions. If maritime shipping were a country, only 5 nations would emit more.

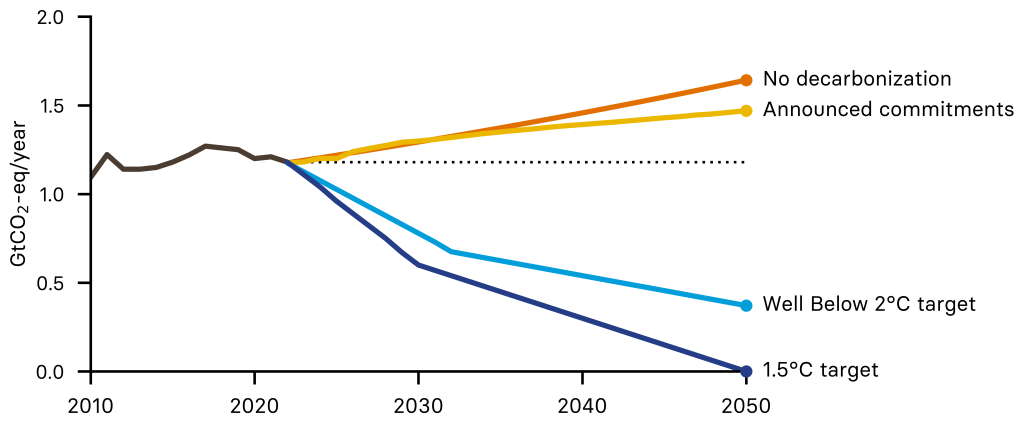

As globalization continues to drive rapid growth in shipping demand, emissions from the sector could increase 40% by 2050 – a trajectory incompatible with pathways that limit global warming to the Paris Agreement targets of 1.5 degrees or well below 2 degrees Celsius. For investors with net zero targets, addressing shipping-related emissions will be necessary to reach them.

Analysis by the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping shows there are plausible pathways to fully decarbonize shipping by 2050. These require that stakeholders take more ambitious action now to accelerate the adoption curve for low-carbon fuels. In contrast with areas such as electricity generation and passenger vehicles where zero-emissions technologies are available and increasingly competitive, solutions for maritime shipping are less mature. By taking steps now to test and de-risk new fuel pathways, stakeholders can reduce long-term costs and manage the risk of price or fuel supply shocks in the future.

Watch the Webinar

Report Highlights

- Maritime shipping is a hard-to-abate sector with significant carbon emissions. Decarbonizing shipping, which is responsible for around 3% of global emissions, requires transitioning the industry from using oil-derived bunker fuel to a range of solutions, at the center of which are new zero-carbon fuels.

- The industry is not on track for alignment with the Paris Agreement. Fully decarbonizing shipping by 2050 is possible but will require that stakeholders take more ambitious steps to reduce fuel usage right away and accelerate the uptake of non-fossil fuels.

- Shipping providers are just starting to focus on carbon. Only 16 of the top ship owners across key industry segments have committed to a net zero target, a key first step toward transition planning. In the near term, ship owners and operators should adopt solutions that reduce fuel usage. Integrating zero-carbon fuels and technologies at increasing scales will accelerate the longer-term transition.

- Shipping customers drive demand for low-carbon shipping. Cargo owners and charterers should signal a willingness to pay for low-carbon supply chain services by prioritizing the use of low-emissions vessels.

- Commitments and disclosures for shipping companies. We identify key “asks” for investors and lenders to make of shipping providers and shipping service users and recommend company-level disclosures.

Global Shipping Solutions

Measures offering significant emissions reductions are available today, and shipping companies should adopt them. However, more dramatic emissions reductions will require significant investments to transition from oil-derived bunker fuel to alternative zero-carbon fuels such as green ammonia or green methanol. Zero-carbon fuels are not yet widely available but are in various stages of readiness; some are drop-in fuels compatible with existing vessels, but most require engine or vessel modifications.

Alternative fuel costs are expected to fall significantly in the coming years, but current projections suggest they will remain more expensive than fossil-based fuels well into the future. There are differences in the performance, cost, operational capabilities and scalability of these potential fuel solutions. A single winner may not emerge – more likely is that the industry will rely on a variety of fuels for different applications, adding complexity to the transition.

To lay the groundwork for introducing alternative fuels at scale, stakeholders including shipbuilders, ship owners and operators, ports, fuel providers and shipping customers must work together to address technical, logistical and institutional barriers. Waiting too long to begin the transition exposes a company to significant technological, financial and reputational risk.

Sign up for future updates from ESG By EDF