- Resources

- Collaborative levers for methane abatement in national oil companies

Resources

Collaborative levers for methane abatement in national oil companies

Published: December 19, 2024 by EDF Staff

In the race to reduce global methane emissions, national oil companies (NOCs) are a wild card. Holders of two-thirds of global oil and gas reserves, NOCs have largely fallen behind their peers in reducing operational methane emissions.

Many lack access to affordable capital to finance methane abatement, and many more face declining access to government credit and demand for ever-higher revenues to finance state expenditures. Financial support from commercial banks, investors, and sovereign creditors is therefore critical to fund NOC efforts to reduce methane emissions.

To be successful, methane abatement efforts must be driven not just by financial and economic motivations, but political motivations as well. As state-owned companies — where politicians and not market investors hold final decision-making power — managing methane within NOCs necessitates buy-in from a range of diverse political actors across ministries, regulatory agencies, oversight bodies, and, ultimately, political leaders and their constituencies.

About the Author

Author Paasha Mahdavi is Associate Professor of Political Science and Environmental Science and Management at the University of California, Santa.

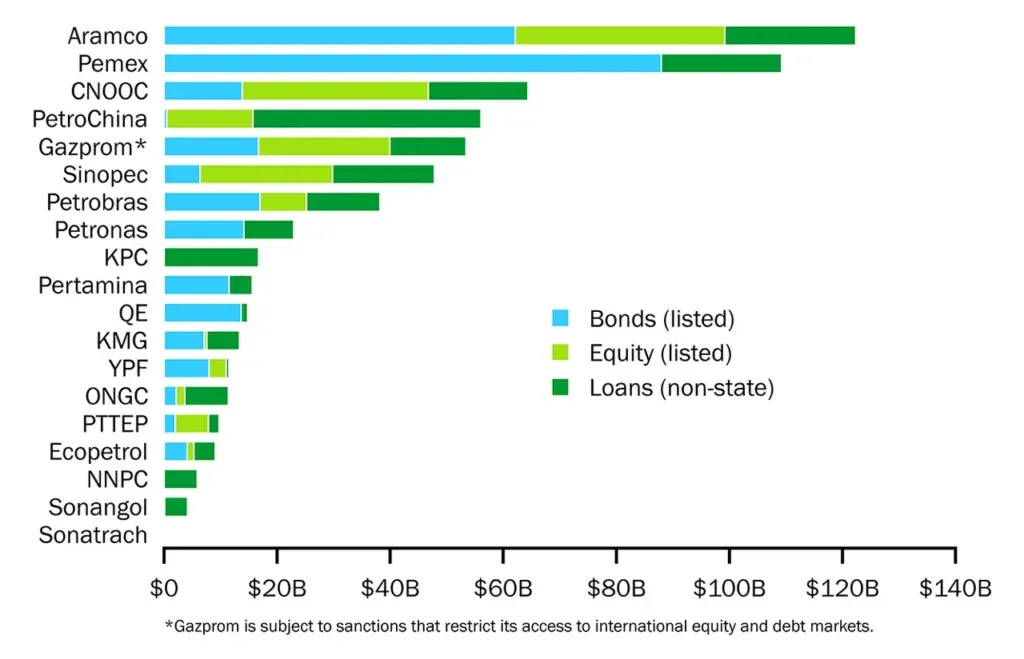

Financial exposures

Though NOCs vary considerably in size, scope, and mandate, external financing has become an important lifeline for NOCs of all stripes. NOCs pursuing large-scale projects have increasingly turned to commercial financiers as governments have limited profit reinvestment into capital expenditures and, in some cases, increased royalties, taxes, and dividends paid to the state.

The rising need for outside capital has affected even the most closed-off NOCs, as governments in Angola, Iraq, and Saudi Arabia have called for ever-more NOC revenues in order to finance expenditures on broader state goals of economic diversification, the energy transition, the expansion of social programs, and the consolidation of political coalitions in the wake of the pandemic and geopolitical turmoil. Even NOCs that primarily finance operations internally, such as the National Iranian Oil Company or Venezuela’s PdVSA, still draw on out-of-country financial services in the form of tanker insurance and product swaps.

Levers of influence

Collaborative approaches between financial institutions and NOCs will be key to progress on NOC methane, and can use four levers to achieve deep and sustained methane reductions:

- Sustainable finance: Exposure to global markets provides opportunities for investors to incorporate methane-related targets and conditions into NOC financing instruments and commercial agreements.

- Financial statecraft: Governments choose a variety of different financing options based on both access to capital and political costs and benefits in each choice. Sovereign lending options such as sustainability-linked bonds or the IMF’s Resilience and Sustainability Trust can play to these factors while incorporating methane abatement conditions as incentives.

- Trade policy: Importing countries can apply demand-side pressure using supply-side policies that incentivize methane abatement. Policies like the EU’s methane rule on imported oil and gas and the possible expansion of carbon border adjustment mechanisms across the OECD can drive methane emissions reductions if NOCs seek continued access to these markets.

- Civil society: Citizens are the ultimate owners of the oil and gas resources that NOCs steward. The immense potential of civil society engagement means that it should not be overlooked as a lever, especially in emerging democracies.

Recommendations

The financial sector can use the following strategies to incorporate methane emissions reductions into specific instruments and agreements:

- Deepen collaboration for improved measurement of methane emissions

- Identify political wins for methane abatement in producing countries

- Craft creative solutions for sovereign lending to finance methane abatement

- Experiment with trade policy in importing countries to drive methane abatement from exporting countries

Putting politics first, rather than simply seeing methane abatement through technocratic and economic lenses, will ultimately increase the likelihood of making progress on reducing methane emissions from NOCs.

Collaborative levers for methane abatement in national oil companies

National oil companies dominate industry methane emissions; enlisting them to clean up requires understanding the governments that manage them.

-

Actionable insights for a decarbonizing worldLearn More