- Resources

- How financial institutions can propel maritime shipping towards decarbonisation

Resources

How financial institutions can propel maritime shipping towards decarbonisation

Published: July 21, 2025 by Guillaume Morauw

By Guillaume Morauw, EDF and Dana G. Rodriguez, Lloyd’s Register Maritime Decarbonisation Hub

The maritime shipping industry, responsible for transporting around 80% of global trade, is at a pivotal moment in its history. The International Maritime Organization (IMO) has set a North Star for shipping to transition to net-zero by, or around, 2050, with indicative checkpoints for years 2030 and 2040. Achieving these goals will require technological innovation, support from financial institutions, and appropriate regulatory frameworks.

Environmental Defense Fund (EDF) and the Lloyd’s Register Maritime Decarbonisation Hub have joined forces to explore how sustainable finance can help meet this ambitious and important goal. Building on an EDF discussion brief that identified barriers to progress, the partnership focuses on strategic stakeholder engagement and research to unlock the capital flows needed to decarbonise the shipping industry.

A workshop held at the IMO in late 2024 kickstarted this work by convening industry professionals, financiers and policymakers to pool their expertise and identify actionable solutions. The session sparked valuable connections among stakeholders and led to discussion on potential solutions to long-standing challenges.

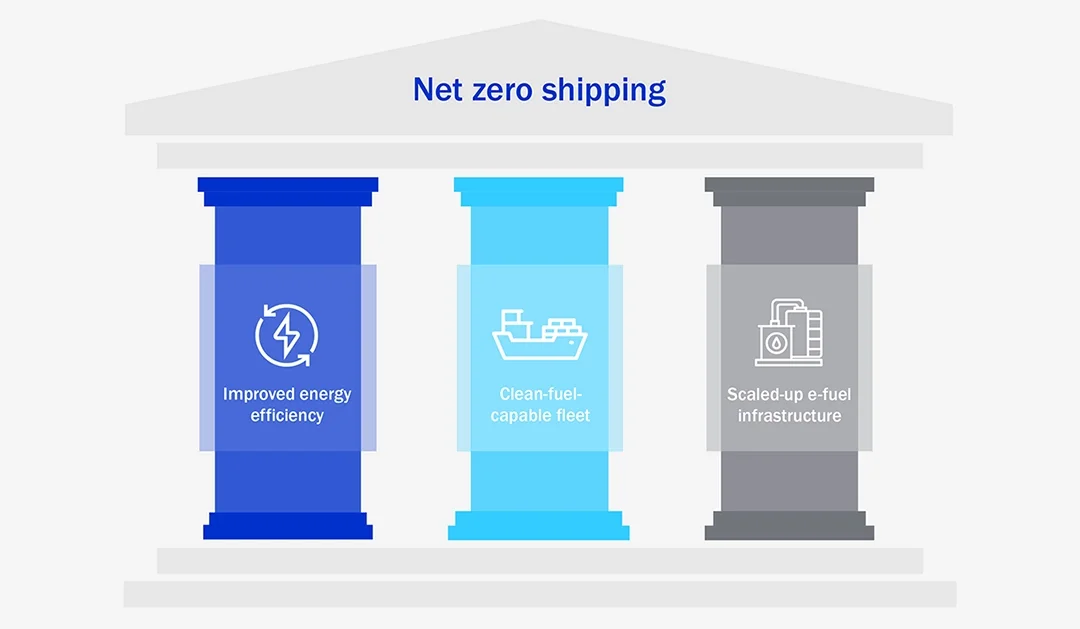

Net-zero shipping requires collaborative action on multiple fronts

The journey to net-zero emissions demands a multifaceted approach. This includes improving energy efficiency in existing vessels, transitioning to a clean-fuel-capable fleet, and developing the production and distribution infrastructure necessary to scale up the adoption of e-fuels for shipping.

However, financing these initiatives remains a substantial challenge. The shipping and finance sectors, with the support of policymakers, must collaborate to tackle the obstacles that impede capital from flowing at the pace needed to decarbonise. The EDF-Decarb Hub workshop explored three critical areas where collaboration can drive transformative change.

Enabling and incentivising investments in efficiency and retrofits

Why is it important?

Technological and operational innovations including wind-assist technology, route optimisation, and air lubrication can deliver reductions in emission intensity in the short term. These energy efficiency measures enable the current fleet to contribute to decarbonisation while reducing shipowners’ exposure to climate transition risks such as stranded asset risk amid stricter GHG regulations. Looking further ahead, the replacement of older vessels running on conventional fuels with new ones that are capable of sailing on zero- or near-zero emission fuels will be gradual, and these clean alternative fuels – which may work only with newer-generation vessels – will likely be in short supply in the early stages of the transition. Vessel efficiency and optimisation will thus continue to be important in the longer term to help manage fuel supply constraints during the transition and lower the amount of clean fuel required. Improved efficiency also enhances the shipping value proposition for financial institutions by helping banks lower the emissions tied to their shipping portfolios.

Challenges

The lack of strong commercial incentives for shipowners to invest in energy-saving technologies (ESTs) and retrofits has restricted demand for financing these projects. The buoyant ship charter market has incentivised shipowners to keep their vessels in service and has enabled them to finance smaller EST and retrofit projects without external capital. However, the sector is likely to see a surge in EST and retrofit projects – and corresponding financing needs – in the future due to growing sustainability regulatory requirements and cyclical market downturns. Smaller shipowners may face particular difficulties accessing affordable financing due to limited balance sheets and lack of capital market access.

Approaches

To increase access to affordable capital for shipowners while minimising risks for financial institutions, stakeholders discussed the creation of a private-public fund structure acting as an independent lender specifically for EST and retrofit projects. A sufficiently large and diverse fund could attract insurers and Export Credit Agencies (ECAs) to contribute to de-risking efforts by offering performance guarantee products. Additionally, shipowners could further reduce borrowing costs by pooling their projects to form joint borrowing entities with stronger credit profiles.

Fostering engagement and support from public and private finance to shipping’s transition

Why is it important?

The European Union’s report on The Future of European Competitiveness – widely known as the Draghi report – estimates that decarbonising the international maritime sector will require around €39bn per year in investment. Public financial schemes and funding programmes play an important role in bridging this gap. In the EU, emission allowances deployed under the EU Emissions Trading System are expected to generate around €1.6bn to be directed into the EU Innovation Fund to support the transition of the maritime sector. At the international level, the IMO is expected to adopt a GHG pricing mechanism in 2025 and the revenues from this could be redistributed to the shipping industry to facilitate its energy transition. While public finance tools can provide foundational support, much of the required investments will need to come from private financiers.

Challenges

Shipping’s critical role in securing global supply chains, energy distribution, and food security is often undervalued, resulting in insufficient public financial support. At the same time, financial regulation – particularly Basel IV – can be unfavourable to shipping, and banks’ green financing ambitions can incentivise allocation of capital to industries that are already green rather than hard-to-abate industries like shipping. While criteria for green shipping exist (e.g., EU Taxonomy, Climate Bonds Initiative), compliance remains challenging as zero-emission technologies and fuels are still in the early stages of development.

Approaches

Raising awareness and recognition of shipping’s strategic importance to national infrastructure and the global economy could bolster public and private financial support in shipping and a more favourable policy environment. Additionally, defining transition finance for shipping could provide the clarity and certainty that financial institutions need to invest in shipping’s transition while meeting their sustainable finance (including green and transition finance) targets.

Accelerating financing and/ or funding for e-fuel infrastructure development

Why is it important?

The 2023 IMO GHG Strategy sends a clear signal that fossil fuels cannot power the industry for much longer. Production and use of clean fuels, like e-methanol and e-ammonia, will be essential to achieve shipping’s net zero ambitions. This will mean scaling up new energy supply chains and the infrastructure (fuel production plants, storage facilities, and distribution networks) that can supply zero-emission vessels with the fuels they need to operate.

Challenges

The mismatch between long-term fuel contracts and spot bunkering markets creates barriers to securing commercially binding, and bankable, fuel offtake agreements which are necessary for fuel supply infrastructure projects to reach Final Investment Decisions. This results in limited availability and higher costs of clean fuel. Integrated solutions and incentive structures should be developed to mobilise finance and funding towards clean fuel infrastructure.

Approaches

Workshop participants highlighted several potential and innovative strategies to close the fuel cost gap and mitigate risks, including bringing together strategic players across the shipping value chain with strong balance sheets as potential equity owners in clean fuel projects, facilitating long-term offtake agreements by breaking them into smaller exchangeable pieces, and encouraging ECAs to collectively develop tools that they can use to support infrastructure investments for maritime decarbonisation.

Breaking silos: dialogue and collaboration for actionable solutions

The transition to net-zero shipping is a monumental challenge, but an unparalleled opportunity to reshape the maritime industry for a sustainable future. Through strategic collaboration, innovative financial mechanisms, and a supportive policy environment, the shipping and finance sectors can navigate the route to net zero together, meeting the IMO’s ambitious targets and contributing to global climate goals.

By fostering collaboration for the development of actionable solutions, EDF and the Decarb Hub aim to drive real progress. Building on the insights and ideas from this workshop, we expect to publish a joint report later this year. We encourage expert stakeholders to connect with us, whether to contribute their expertise or explore and learn more about this vital initiative.

Contact the authors:

Guillaume Morauw (gmorauw@edf.org) – Environmental Defense Fund

Dana Rodriguez (dana.rodriguez@lr.org) – Lloyd’s Register Maritime Decarbonisation Hub