- Resources

- Inflation Reduction Act Activation Guide: Advanced Manufacturing

Resources

Inflation Reduction Act Activation Guide: Advanced Manufacturing

Published: May 2, 2023 by Giada Mannino

Any company that owns or sources from industrial facilities may benefit from IRA incentives.

- Automotive

- Consumer Products

- Clean Energy Inputs

- Batteries

- Machinery

- Mining

- Paper

- Plastics

- Cement

- Steel

- Glass

- Chemicals

Key Relevant Provisions

§45X and §48C are the key provisions to know for advanced manufacturing, offering incentives for domestic clean technology and energy efficient manufacturing.

§45X: Advanced Manufacturing Production Credit

Provision

Provides a new production tax credit for the manufacture or assembly of certain eligible clean technology components sold to an unrelated person beginning in 2023.

Key Takeaways

- Covers a variety of components such as solar energy, wind energy, inverters, qualifying battery components, and critical minerals, among others

- Like the renewable energy generation tax credits, uncapped production credit with no annual funding limits

- Begins to phase out in calendar year 2030, completely phasing out by 2033 (exception applies for critical minerals)

- Eligible for direct pay for 5 years and transferable

- Denial of double benefit for components produced in a facility for which Sec. 48C has been authorized

§48C: Advanced Energy Project Credit

Provision

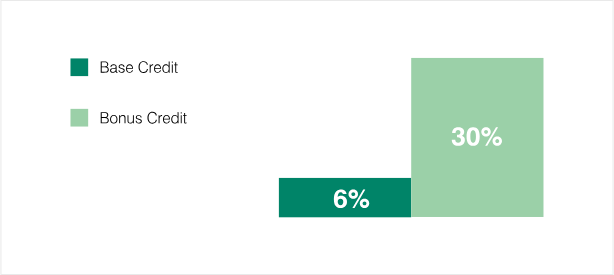

Provides a tax credit of 6% or 30% for re-equipping, expanding, or establishing an industrial or manufacturing facility for clean technology components.

Key Takeaways

- Covers a variety of investments (incl. energy efficiency and GHG reduction retrofits) in manufacturing facilities and capabilities such as energy storage systems, critical minerals processing and recycling, and grid modernization equipment

- Competitive application process scored and administered by the IRS in consultation with the Department of Energy (DOE)

- Must meet prevailing wage and apprenticeship requirements for the full 30% rate. If such requirements are not met, the credit is reduced to 6%

- Denial of double benefit with other applicable credits such as Sections 45X, 48, 48A, 48B, 48E, 45Q, or 45V

Notes: Unless otherwise specified, all references to “Section” in this presentation are to the Internal Revenue Code of 1986, as amended (IRC).

Sources: Deloitte Analysis, P.L. 117-119, WH IRA Guidebook, IRC.

§45X: The advanced manufacturing production tax credit covers a wide scope of clean technology manufacturing activities and is one of the most impactful IRA provisions

Credit Overview

Provision Description:

Provides a production tax credit for domestic manufacturing of components for solar and wind energy, inverters, battery components, and critical minerals.

Period of Availability:

Permanent for critical minerals. For other items, the full credit is available between 2023-29 and phases down over 2030-32.

Incentive Type:

Production tax credit. Permanent direct pay for tax-exempt entities. 5-year direct pay for businesses until 2032.

New or Modified Provision:

New

- Transferable

- Direct Pay Eligibility

- Not Stackable with §48C

- No Limit to Size of Credit

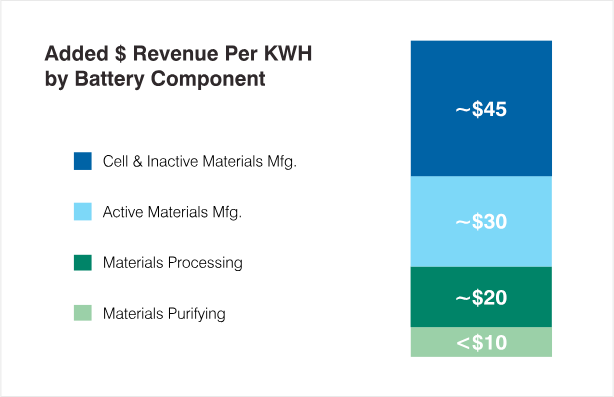

Tax Credit Amount (EV battery example):

Notes

- Bar chart is scaled to $100/kWh excl. module and pack manufacturing.

- §45X includes additional per kWh-based incentives for battery cell assembly into combined modules of approx. $10/kWh.

- Credit amounts vary by each type of eligible component. In the case of an eligible component sold during 2030, 2031, and 2032, the phase out percentages are 75, 50, and 25 percent, respectively.

Eligibility Requirements

Organization Types and Usage:

Domestic manufacturers of eligible components.

Eligible Components:

- Solar Energy Components

- Wind Energy Components

- Inverters

- Qualifying Battery Components

- Critical Minerals

Eligible Activities:

Each value chain participant may stack the credit for every discrete manufacturing, integration, incorporation, or assembly step of eligible components.

Available January 1, 2023 until December 31, 2032 for most components.

How to Claim the Credit

- Complete IRS Form 7207 to claim the Advanced Manufacturing Production Credit

- Follow the Instructions for Form 7207 released by the IRS when completing the form

- Reference additional information regarding the Advanced Manufacturing Production Credit

§45X: The advanced manufacturing production tax credit provides different incentive levels by clean technology type

Production Credit Amounts by Component Types

Sources: Deloitte Analysis, P.L. 117-119, WH IRA Guidebook, IRC.

§48C: The Advanced Energy Project Credit provides funding for clean technology manufacturing and investments in energy efficiency and GHG reduction in industrial facilities

Credit Overview

Provision Description:

Provides a tax credit for investments in manufacturing capacity for clean energy technologies (including production and recycling), projects to reduce industrial GHG emissions and energy consumption, and critical minerals processing and recycling facilities.

Period of Availability:

Round 1 applications begin May 31, 2023, and funding is available until 1st round of credits is allocated ($4 billion, ~$1.6 billion earmarked for energy communities). Round 2 applications will likely begin when 1st round of funding is exhausted.

Incentive Type:

Allocated investment credit. Provides $10 billion of allocations, at least $4 billion of which must be allocated to energy communities.

New or Modified Provision:

Modified and extended. §48C was enacted in 2009 and fully allocated in 2013. IRA provides $10 billion of new allocations, directs a minimum share to energy communities, and expands eligibility to new types of projects.

- Transferable

- Direct Pay for Tax-Exempt Organizations

- Not Stackable with §45X

- Competitive Credit with $10 B Cap ($4 B in Round 1)

Tax Credit Amount (in %):

Bonus Credit is awarded for meeting Prevailing Wage & Apprenticeship requirements (5x bonus multiplier times the base).

Eligibility Requirements

Organization Types and Usage:

Manufacturing facilities for renewables equipment/components, grid modernization, CCUS, low carbon fuels, energy conservation, and EV/fuel cell vehicles, among other technologies.

Qualifying Facilities:

- Re-equip, expand, or establish an industrial or manufacturing facility for the production or recycling of eligible components;

- Re-equip an industrial or manufacturing facility with equipment to reduce GHG emissions by 20% through the installation of low-carbon heat systems, CCUS, energy efficiency and reduction in waste, or any other eligible industrial technology to reduce GHG emissions; or

- Re-equip, expand, or establish a facility for processing, refining, or recycling critical minerals

Selection Criteria:

- Domestic Job Creation

- Commercial Viability

- Project Timeline

- Reduction In Energy Consumption or GHG Emissions

- Impact On Air Pollutant and/or GHG Emissions

- Innovation & Commercial Deployment

Concept papers due July 31, 2023 for Round 1; funds available until exhausted.

How to Claim the Credit

- Submit project concept papers to the Department of Energy (DOE) via the eXCHANGE portal by July 31, 2023. Following submission of a concept paper, DOE will encourage or discourage taxpayers from submitting a joint application for DOE recommendation and for IRS §48C cert.

- An applicant who receives a certification has 2 years from the date of issuance of the certification to place the project in service and notify the DOE Secretary through the eXCHANGE portal. The taxpayer can then claim the credit on its income tax return for the taxable year in which the project was placed in service.

- Review the initial IRS guidance on prevailing wage and apprenticeship requirements

- Submit IRS Form 3468 in taxable year that project was placed in service

Sources: Deloitte Analysis, P.L. 117-119, WH IRA Guidebook, IRS, IRC.

Companies are already using §45X and §48C to support their clean manufacturing.

Sources: Ford, First Solar, Siemens Gamesa, WH Archive 48C Selection

Every function has a role to play to take advantage of the IRA to support investment in clean technology manufacturing capabilities.

Strategy

- Assess existing clean technology product portfolio and planned CAPEX against corporate strategy and IRA induced shifts in demand

- Identify priority sites, products, and technologies for investments in manufacturing capabilities and energy efficiency upgrades

Sustainability

- Calculate projected abatement potential (air quality and GHG emissions) for Sec. 48C projects for industrial facilities and compare against goals, strategy and alternatives

Finance

- Refresh business case to include IRA incentives

- Conduct ROI analysis for priority sites, products, and technologies that can benefit from Sec. 45X and 48C

- Assess financial impacts of re-equipping vs. expanding vs. new build of clean technology industrial facilities

Tax

- Review manufactured products and operations for Sec. 45X credit eligibility, including assessment of legal entity structure

- Review new and existing manufacturing sites for Sec. 48C eligibility, collaborate with Strategy and Operations on Sec. 48C concept paper and application

- Analyze value of direct pay vs. using credits pursuant to Sec. 38

Operations & Procurement

- Engage with Strategy and Tax to determine eligible product lines for Sec. 45X and track production volumes in the required format for IRS Form 7207

- Collaborate with Strategy, Finance, and Tax to identify suitable site for investments in clean technology manufacturing for Sec. 48C

Government affairs

- Identify additional federal, state and local incentive structures

- While the comment period for both Sec. 45X and Sec. 48C closed on November 4, 2022, the IRS will consider comments provided after this date (reference IRS-2022-0047 in comment)

Credit: Environmental Defense Fund and Deloitte

This document was produced by Environmental Defense Fund in collaboration with Deloitte Consulting LLP. The views within the report are that of Environmental Defense Fund, and do not necessarily reflect the views of report partners or collaborators.This document contains general information only and Deloitte is not, by means of this document, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This document is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this document.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. Please see www.deloitte.com/about for a detailed description of DTTL and its member firms. Please see www.deloitte.com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries. Certain services may not be available to attest clients under the rules and regulations of public accounting.Copyright © 2023 Deloitte Development LLC. All rights reserved. 36 USC 220506 Member of Deloitte Touche Tohmatsu Limited