- Resources

- MethaneSAT: What you need to know

Resources

MethaneSAT: What you need to know

Published: March 4, 2024 by Andrew Howell

What does MethaneSAT offer for the financial sector?

Methane emissions are a material component of business activity. Methane management is increasingly being factored into the valuation of oil and gas assets, and buyers may consider emissions data for regulatory and business purposes.

MethaneSAT data will make it easier to track producers’ methane emissions performance against legal and voluntary targets and analyze results compared with peers.

What data will MethaneSAT produce?

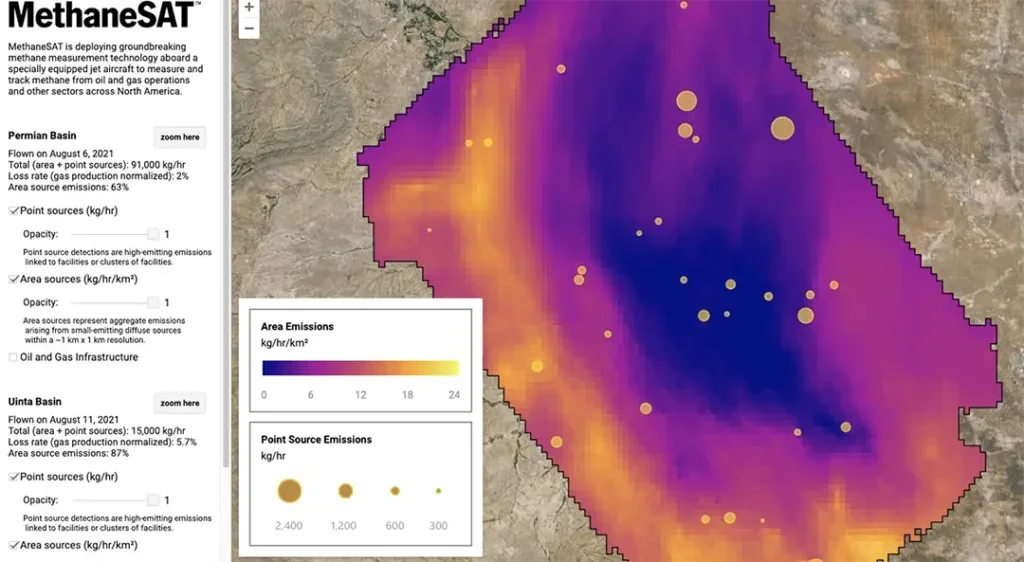

Starting in early 2025, MethaneSAT emissions data will be freely available to view on the MethaneSAT website. It will also be available to download on Google Cloud Marketplace and for analysis on Earth Engine.

Example of how data will be visualized in Google Earth Engine

Next steps for financial institutions

In the months ahead, MethaneSAT will begin producing data that will change the financial sector’s ability to manage risk associated with oil and gas methane. Starting in early 2025, this data will be available to the public. Investors, lenders, insurers and other finance providers should prepare to leverage the greater transparency it will bring.

Steps financial institutions can take now:

- Work internally with data teams to build capacity to receive and use this data

- Engage with third party data vendors to ensure integration of MethaneSAT data when available

- Signal to companies in the oil and gas supply chain that you plan to use this new data source

- Subscribe to EDF’s sustainable finance newsletter for updates on MethaneSAT data availability.

MethaneSAT: What you need to know

A Q&A for investors

For the finance sector, MethaneSAT satellite data will enable a step change in oil & gas risk and performance evaluation.