- Resources

- Missing methane: A European perspective

Resources

Missing methane: A European perspective

Published: July 18, 2024 by EDF Staff

Introduction

Methane emissions pose fundamental financial, regulatory and reputational risks to oil and gas operators which may lead to significant impacts on banks’ portfolios. Banks themselves face reputational risks if they do not engage with oil and gas clients to address this important issue – including risk of failing to meet their own climate targets.

We reviewed the methane disclosures and policies of seven European banks with significant oil and gas financing activity and assessed their disclosures and targets for methane emissions. Our recommendations can help banks better manage financed emissions in their oil and gas portfolios.

Sizing up bank methane performance

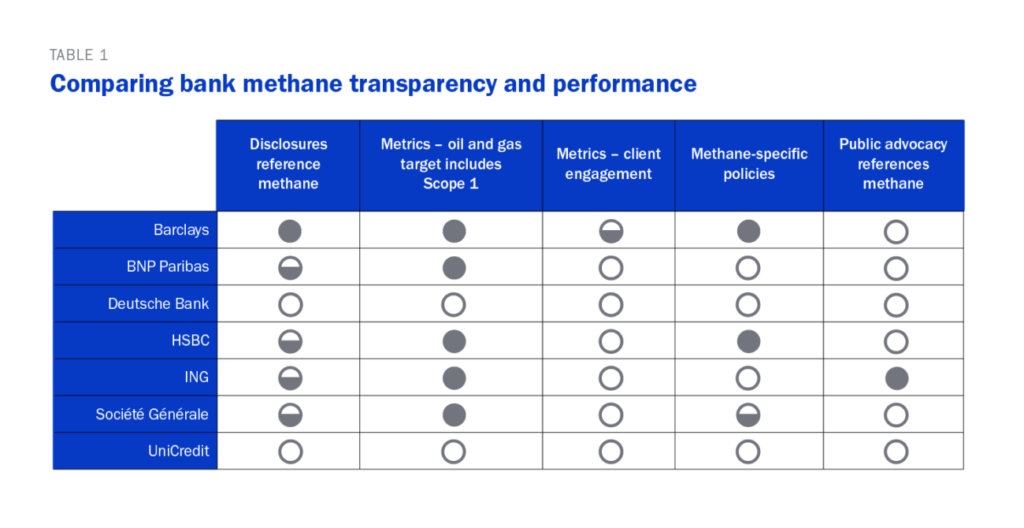

Our analysis of seven major European banks – Barclays, BNP Paribas, Deutsche Bank, HSBC, ING, Société Générale and UniCredit – found that none of them is putting sufficient attention on engaging with oil and gas clients on near-term methane emission reduction.

- Overall, banks lack detailed methane disclosures and targets.

- Barclays, HSBC and Société Générale are the only banks that have defined specific policies relating to methane when engaging with oil and gas clients. ING is the only bank that has mentioned public advocacy engagement action on methane in its disclosures.

- Two banks – Deutsche Bank and UniCredit – disclose only Scope 3 financed emissions, meaning they are overlooking opportunities to engage with their oil and gas clients on Scope 1 methane emissions.

Our recommendations

We call on banks to make immediate methane emission reductions a central focus in their sustainability strategies.

1. Banks should improve reporting and target setting:

- Target scope at a minimum should include upstream clients’ operational (Scope 1 and 2) and end-use (Scope 3) emissions in oil and gas targets.

- Metrics should break out financed methane emissions separately from financed CO2 emissions.

2. Banks should engage oil and gas clients more deeply on near-term methane emission reductions:

- Set and publish oil and gas sector policies which include expectations for clients’ methane performance.

- Support clients in measuring and mitigating methane emissions.

3. Banks should publicly support strong methane policies:

- Advocate for strong methane policies and regulations internationally to reduce methane emissions and improve measurement, reporting and verification.

Missing Methane: A European Perspective

European banks face significant risk from oil and gas methane emissions in their portfolios. Our recommendations can help banks manage them.