- Resources

- Santos: Methane emissions and the collapse of a global gas deal

Resources

Santos: Methane emissions and the collapse of a global gas deal

Published: October 8, 2025 by Andrew Howell

By Charlotte Hanson and Andrew Howell, CFA

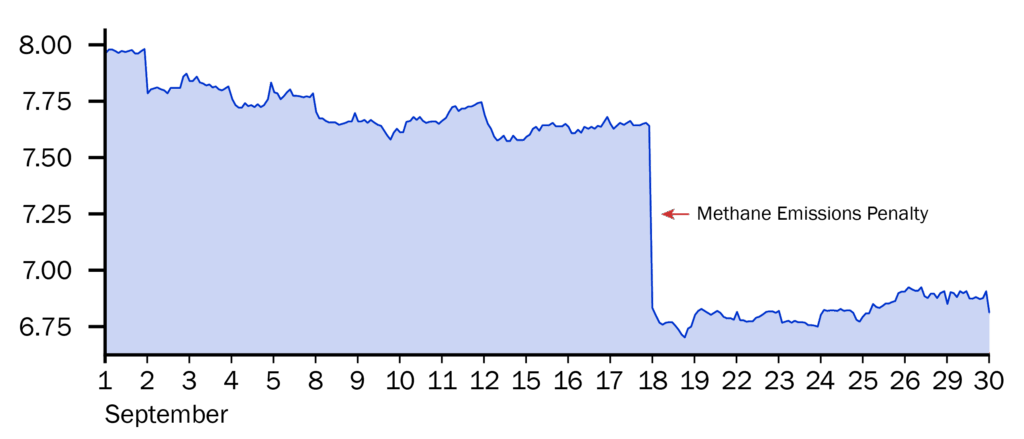

Companies that fail to manage methane emissions expose themselves, their investors and other stakeholders to serious risk. The collapse of a landmark Australian gas export infrastructure deal last month provided an important reminder of this for the financial community. The Abu Dhabi National Oil Company (ADNOC) withdrew its bid for Australian oil and gas company Santos, in what had been the largest all-cash takeover bid in Australian stock market history at A$36 billion. The Santos share price fell sharply, erasing A$3b (US$2b) from the company’s market valuation.

Poorly managed emissions of methane – a greenhouse gas that drives 80 times more warming than carbon dioxide over its first 20 years in the atmosphere – appear to have played a central role in ADNOC’s decision to drop out of the deal. In early September, reporting by the Australian Broadcasting Corporation (ABC) revealed a years-long methane leak at Darwin LNG, a liquefied natural gas storage facility operated by Santos in northern Australia. Subsequent reporting by Australian media outlets including the Australian Financial Review indicated that ADNOC only learned of the leak when the due diligence process was well advanced, and that this discovery played a significant role in the collapse of the sale.

The Santos story is a stark reminder of the business case for prudent methane management – and the consequences of neglecting this financial and environmental risk. Regulators in the European Union, Asia and other economies are increasing their scrutiny of methane emissions associated with imported oil and gas. At the same time, new satellite-based measurement tools are making it easier to spot methane emissions anywhere in the world. This all adds up to an environment that is increasingly unforgiving of operators who neglect best practices for detecting and abating this potent greenhouse gas.

A long-neglected emissions source

The leak at the Darwin facility was not new. When the tank was built in 2006, then-owner ConocoPhillips had problems with it almost immediately, according to the ABC’s reporting, as liquefied natural gas escaped the chamber and caused cracking in the tank. In 2019, drone measurements by the company reportedly indicated that the tank was releasing up to 184 kilograms of methane an hour when full, the equivalent of putting 8,300 new cars onto the road each year. ConocoPhillips had initially reported the fault to workplace safety regulators but did not fix the damage.

ConocoPhillips sold the Darwin project to Santos in May 2020. While the leak had not been publicly reported at the time of the sale, according to the ABC a deal insider said Santos “knocked down the price based on their knowledge of the leak.”

Methane under scrutiny

That the Darwin leak remained unaddressed for two decades points to failures by both the operators and regulators to take action. But for investors, the takeaway from last month’s deal collapse is clear: companies will be scrutinized on the robustness of their efforts to manage methane. In the case of Santos, one red flag was the company’s failure to join the Oil and Gas Methane Partnership 2.0 (OGMP 2.0).

OGMP 2.0 is a voluntary methane monitoring, reporting and verification protocol developed through a collaboration between industry, UNEP and civil society. It has over 150 member companies around the world that commit to undertaking detailed emissions measurements and analysis across their asset base. This process helps companies identify and manage anomalous emissions, such as leaks.

Santos is the only major gas producer operating in Australia that has not signed on to the protocol. Australia’s other major gas company, Woodside, joined in January 2024. The absence of any company from the rolls of OGMP 2.0 should alert investors to the need for enhanced scrutiny of that company’s methane risk.

A market mismatch

ADNOC has not stated its reasons for withdrawing its bid for Santos, but it seems plausible that concerns about methane management played a role. In recent years, ADNOC has positioned itself as a global leader in measuring and reducing methane emissions. The company played a central role in hosting the COP28 climate summit in Dubai, at which time it launched the Oil and Gas Decarbonization Charter. As a member of OGMP 2.0, ADNOC must consider how methane leaks and the quality of direct measurement data from new assets could affect its overall methane performance and ability to hit targets.

Beyond reputational concerns, ADNOC’s decision may also reflect a strategic calculation about future market access. One of the attractions of acquiring Santos is the opportunity to expand sales of Australian LNG into fast-growing Asian markets. Yet these same markets – particularly Japan and South Korea – are tightening expectations around methane intensity as part of the Coalition for LNG Emission Abatement toward Net-zero, or CLEAN, initiative. Over time, demonstrating low emissions may become a prerequisite for maintaining market share, especially as these countries move toward cleaner energy imports to meet decarbonization goals.

The 2024 CLEAN annual report notes that Santos’s Darwin LNG facility already supplies both Japan and South Korea, but evidence of high methane leakage could jeopardize such export prospects. The Australian government has endorsed the initiative and signalled plans to curb methane emissions from LNG facilities while commissioning a panel of experts to advise on energy sector methane reporting methodologies. In this context, an investment in Australian assets with poorly controlled methane emissions could undermine ADNOC’s broader positioning as a supplier of lower-methane gas to major markets, and expose it to regulatory and reputational risk. While Santos (as well as Woodside) has formally acknowledged CLEAN, firm action on methane is required to avoid these risks.

Minimizing methane surprises

ADNOC’s withdrawal from the Santos purchase provides another proof point for the materiality of methane emissions, in addition to those offered by proliferating regulatory requirements, evolving customer preferences, and clear linkages to financial and operational performance.

To help drive sound risk management and improved performance, investors should engage with oil and gas operators to ensure they are taking the full range of actions consistent with best practice on methane. In particular, these three measures are critical:

- Membership in OGMP 2.0. Membership requires companies to measure and report methane emissions across their assets, with best practice guidance and a pathway for continued improvement.

- Adoption of a near-zero methane emissions intensity target. A strong methane target is central to driving emissions reductions across all assets, and near-zero (<0.2%) methane emissions intensity targets have been widely adopted by many oil and gas companies, such as signatories to the Oil and Gas Decarbonization Charter.

- Reporting emissions from non-operated assets and joint ventures (NOJVs). Most environmental reporting is limited to assets owned and operated by the company in question, and excludes those that are operated by a partner (non-operated assets) or are jointly owned. Emissions reporting should cover all assets in which a company holds economic interests to improve the management and disclosure of associated emissions.

Assessing company performance on these indicators can help investors identify and manage methane risks – and avoid unwelcome surprises during dealmaking.

For a primer on methane risk, see EDF’s Plugging the leaks: An investor guide to oil and gas methane risk. For more on corporate transparency around methane management, see the 25 indicators and assessment criteria developed under Turning Pledges into Progress: An accountability framework for reducing emissions from the oil and gas industry, by the International Energy Agency, UN Environmental Programme and EDF.

Investor briefing

EDF will hold an investor briefing on this topic on October 23rd, 2025, at 9am ET, exploring what the ADNOC withdrawal means for company and investor action on methane. The conversation will cover the regulatory and operating environment affecting leak management, potential risks surrounding takeovers of oil and gas assets, and how established industry protocols such as the Oil and Gas Methane Partnership 2.0 can reduce risks for companies and investors.