- Resources

- Stakeholder guide to the SEC’s proposed rule on climate-related disclosure

Resources

Stakeholder guide to the SEC’s proposed rule on climate-related disclosure

Published: April 4, 2022 by EDF Staff

On March 21, 2022 the Securities and Exchange Commission (SEC) released a proposed rule for “The Enhancement and Standardization of Climate-Related Disclosures for Investors.” The proposal sets forth standards requiring publicly traded companies in the U.S. to disclose certain types of climate-related information, building on the widely accepted Task Force on Climate-Related Financial Disclosures (TCFD) framework and aligning U.S. markets with disclosure regimes in other jurisdictions including the European Union, United Kingdom, and Japan.

The proposed rule would improve upon the current state of play, defined by inconsistent, vague reporting of climate risk exposure, by calling for comparable, specific disclosures that would enhance investor and corporate climate risk management. Adoption of the proposal would strengthen investors’ capacity to manage portfolio-wide climate risks, protecting the overall health of the financial system.

Report highlights

- A new proposed rule from the SEC would help investors obtain comparable, specific, and decision-useful climate risk information. The proposal, open for public comment through June 17, calls for climate risk disclosure from publicly traded companies, building on the widely used TCFD framework.

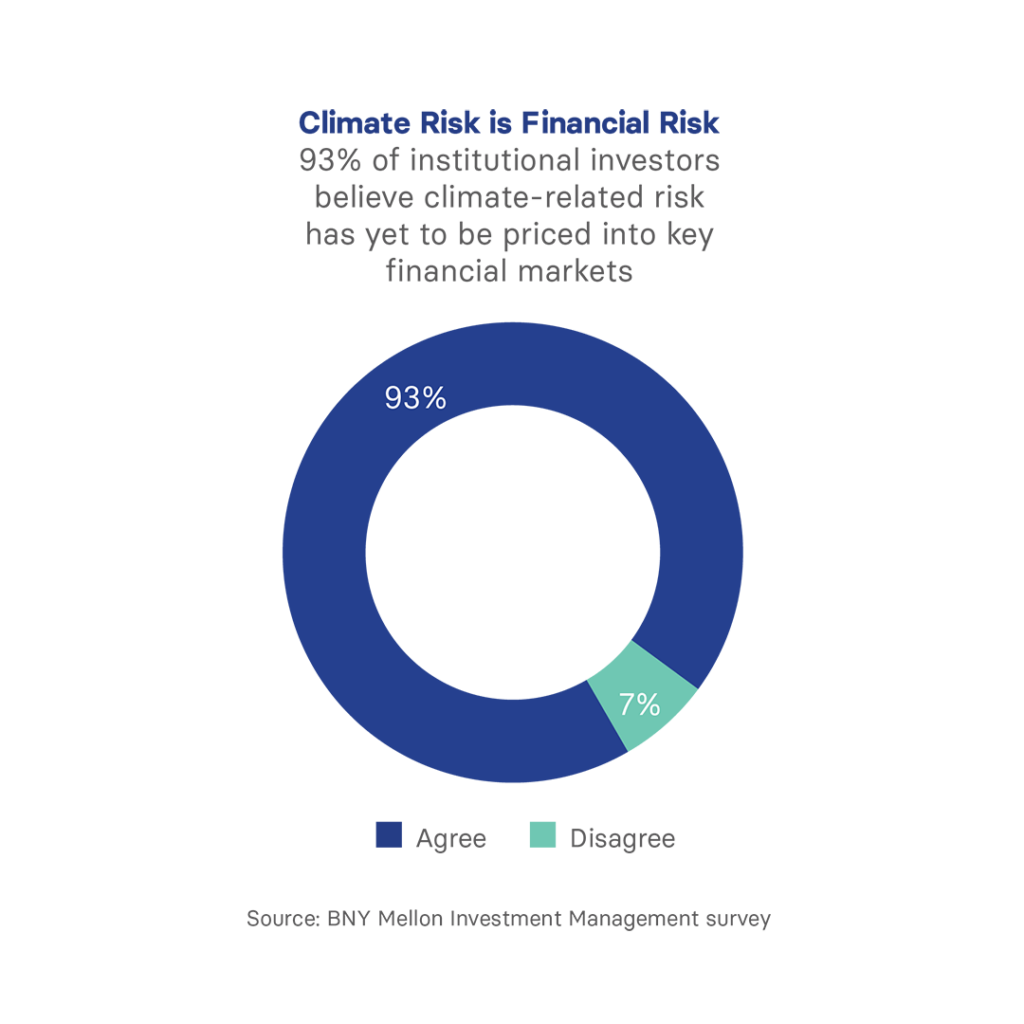

- Improving climate risk disclosure is a key first step to protecting the U.S. financial system from mounting risks presented by climate change. Climate change poses major physical and transition risks with important implications for investors and the U.S. economy. To price risks accurately and allocate capital responsibly and efficiently, investors need rigorous, standardized corporate climate disclosures.

- Stakeholders interested in preserving the health and stability of the financial system should comment in support of the proposal, encouraging the SEC to move expeditiously in adopting a final rule on climate risk disclosure. The SEC is currently holding open a comment period, where interested stakeholders can provide feedback and relevant evidence as the Commission seeks to finalize effective, durable disclosure standards that will best serve investment decision-making.

Our recommendations

The SEC proposal is open for public comment through June 17. EDF encourages interested stakeholders to indicate their support for climate risk disclosure by urging the SEC to move expeditiously to finalize and implement this proposed rule. The regulatory docket, including submitted public comments, can be found here. After the public comment window closes, the SEC will review stakeholder comments and consider how to incorporate that feedback into a final rule.

Stakeholder guide to the SEC’s proposed rule on climate-related disclosure

Climate change poses physical and transition risks with implications for investors and the U.S. economy. The SEC’s proposed rule on climate risk disclosure would help maintain the health and stability of the financial system.

-

Mandating Disclosure of Climate-Related Financial RiskView resource

-

Comments to SEC on Climate DisclosureView resource

-

What Investors and the SEC Can Learn from the Texas Power CrisesView resource

-

Climate change creates financial risks. Investors need to know what those areView resource

-

Unpacking the Proposed SEC Rule on Climate Risk DisclosureView resource