- Resources

- Three ways climate risks are increasing costs for businesses

Resources

Three ways climate risks are increasing costs for businesses

Published: August 15, 2024 by EDF Staff

August is here, and it is HOT outside. So hot that climate change-driven extreme weather is accelerating in front of our eyes. Following unusually high temperatures, the U.S. saw more than 100 active wildfires burning in a single day. Climate change is driving more frequent and severe weather events: rampant fires are burning across the globe, sea level rise and hurricanes are inundating coastal regions, severe flooding is surging, and other extreme weather is worsening on a global scale. As this problem intensifies, so too do physical climate risks in the corporate sector.

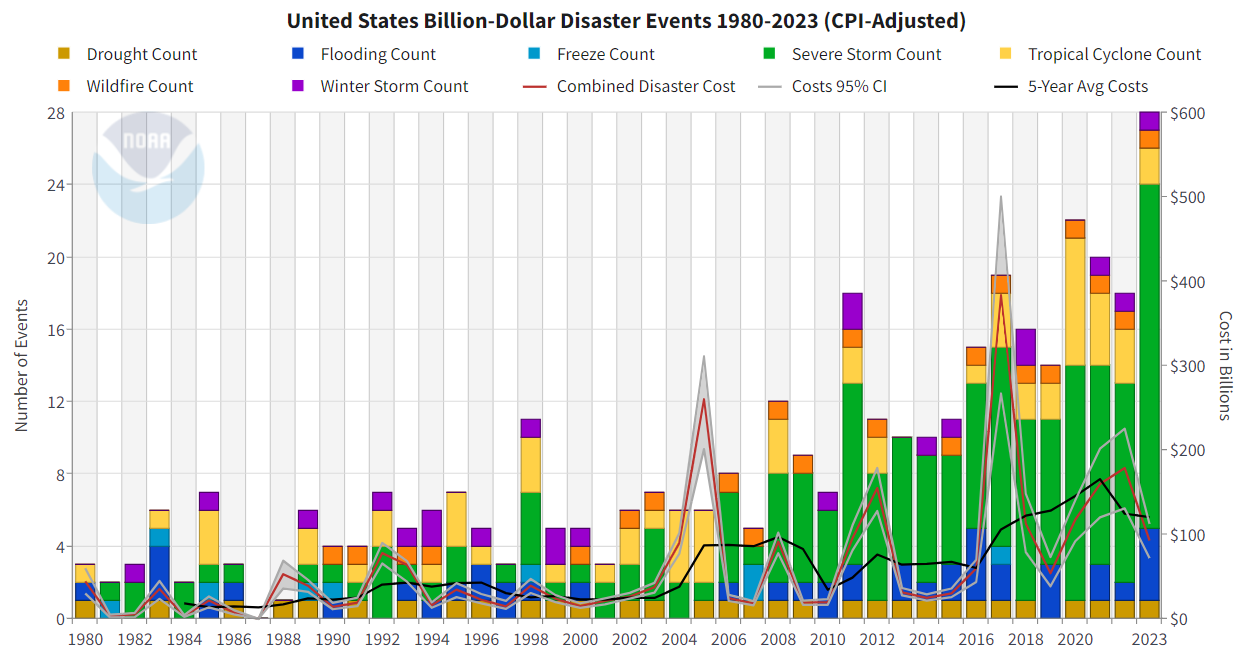

What’s at stake? Climate change is expected to cost $38 trillion in damages per year by 2050. 2023 saw an unprecedented number of billion-dollar disasters – 28 in total – in the U.S. alone. Even companies without directly owned physical infrastructure face threats from climate change impacts – namely in their supply chains. However, assessing and mitigating these risks presents an immense business opportunity.

Implications for Companies

Climate change impacts are disrupting businesses continuity through:

- Energy Volatility: Climate-induced extreme weather is causing energy blackouts, altering energy consumptions patterns, damaging energy infrastructure, and contributing to higher energy prices. About a quarter of global electricity networks face a high risk of destructive cyclone winds and a third of freshwater-cooled thermal power plants are in high water stress areas. These risks are predicted to increase over time.

- Infrastructure Damage: Sea level rise and extreme weather events are damaging critical infrastructure, including trade ports, roads, railways, manufacturing plants, and other key components of supply chain operations. Oxford’s Environmental Change Institute (ECI) found that nearly nine in ten major ports globally are exposed to damaging climate hazards, resulting in escalating economic impacts on global trade.

- Agriculture Disruptions: Droughts, flooding, wildfires and other extreme weather events diminish crop yields and harm animal health, posing a significant financial risk for the food sector. Climate-driven changes in temperature and precipitation are likely to negatively impact crop yields across the U.S. and globally. In 2019 Midwest floods led to a $4.5 billion loss in agricultural sales.

These physical climate impacts disrupt supply chains, making it harder for goods to reach consumers. This also worsens inflation by driving up prices and creating imbalances between supply and demand. Across the global economy, delayed shipping, lost commodities, damaged infrastructure, and closed or altered shipping routes among other issues are costing companies time and money.

Getting Ahead of the Issue

These global events confirm that physical climate risk is financial risk. Regulatory frameworks are maturing to treat it as such. In the European Union, the Corporate Sustainability Reporting Directive (CSRD) calls on companies to identify and assess material climate-related impacts, risks, and opportunities, as well as related financial impacts. In the U.S., the SEC’s climate rule would require companies to outline how climate-related risks impact their business model and financial outlook, and how they plan to mitigate those risks. Globally – the International Financial Reporting Standards (ISSB) requirements include scenario analyses to assess climate-related physical risks and opportunities.

A Strong Business Case for Action

The business case is clear: physical risk assessment is a critical lever to help companies position themselves for long-term, profitable growth. The world’s largest companies report almost $1 trillion at risk from physical climate impacts and $250 billion in potential losses from stranded assets. Companies that effectively assess this risk can also mitigate it, meaning they will save money, increase revenue, and prevent costly damage control measures down the road.

Pathways to Climate Action: Supply Chain Engagement

Getting ahead of these risks can reduce uncertainty and help to future-proof your operations. Scope 3 measurement and reporting has become the new industry standard – and it can be leveraged as a key risk assessment tool. While company procurement teams engage with suppliers to gather emissions data, they can also engage on physical risk: Which suppliers face the largest climate risks? Who has been delayed or impacted by climate-related weather events? By gaining insights into your Scope 3 emissions, you’re inherently gaining insights into your supply chain and its risks. EDF’s Net Zero Action Accelerator includes free resources, trainings, and guidance that can help you get started.

Material risk assessment is the linchpin of smart business strategy. As we observe more and more companies suffer the impacts of climate-related disruptions, one thing is abundantly clear: physical climate risk is material for all companies. Later is too late for climate action; companies’ long-term success and profitability depends on their readiness to act now throughout their value chains.