- Resources

- An investor guide to the climate principles for oil and gas mergers and acquisitions

Resources

An investor guide to the climate principles for oil and gas mergers and acquisitions

Published: March 30, 2023 by EDF Staff

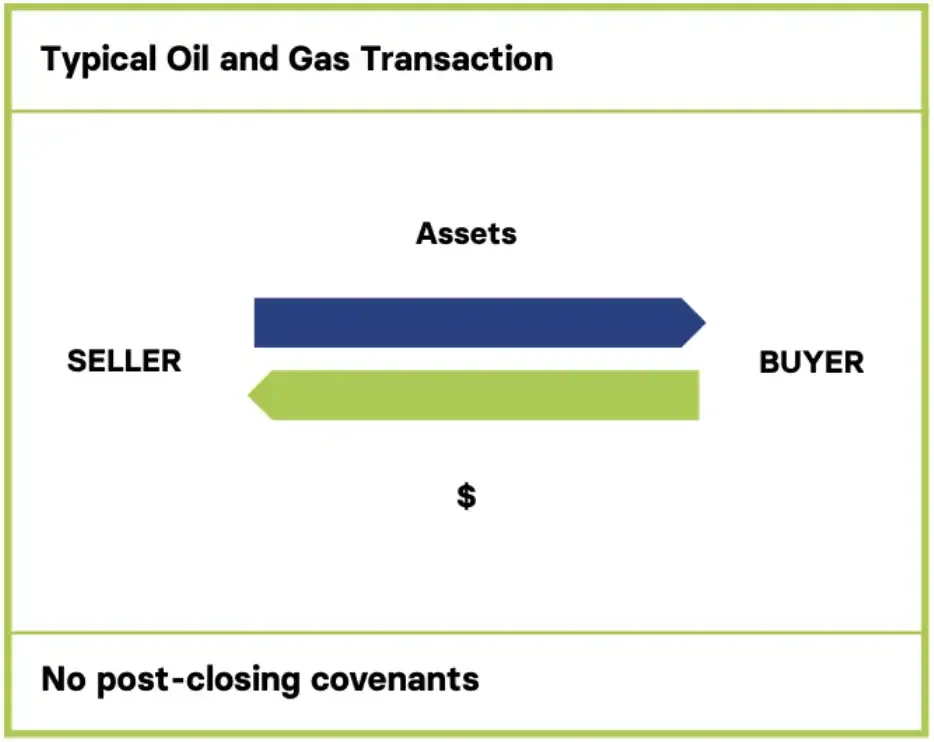

Asset transfer transactions

As oil and gas companies seek to reduce emissions and navigate the risks and opportunities of the energy transition, mergers and acquisitions (M&A) continue to be an integral part of industry business strategies. However, these transactions can result in an increase in overall emissions as assets are shifted from sellers with stronger climate commitments to buyers with weaker commitments.

Transferred emissions create physical, legal, reputational and transition risks for the companies and financial institutions involved.

To help investors assess and manage risk from oil and gas M&A, Environmental Defense Fund and Ceres developed this guide that presents actionable steps and real-world examples of current industry best practice.

Implementing this guidance can create opportunities for all parties involved to create long-term value, and lead to a new paradigm for oil and gas transactions that is more compatible with global net zero goals.

Report highlights

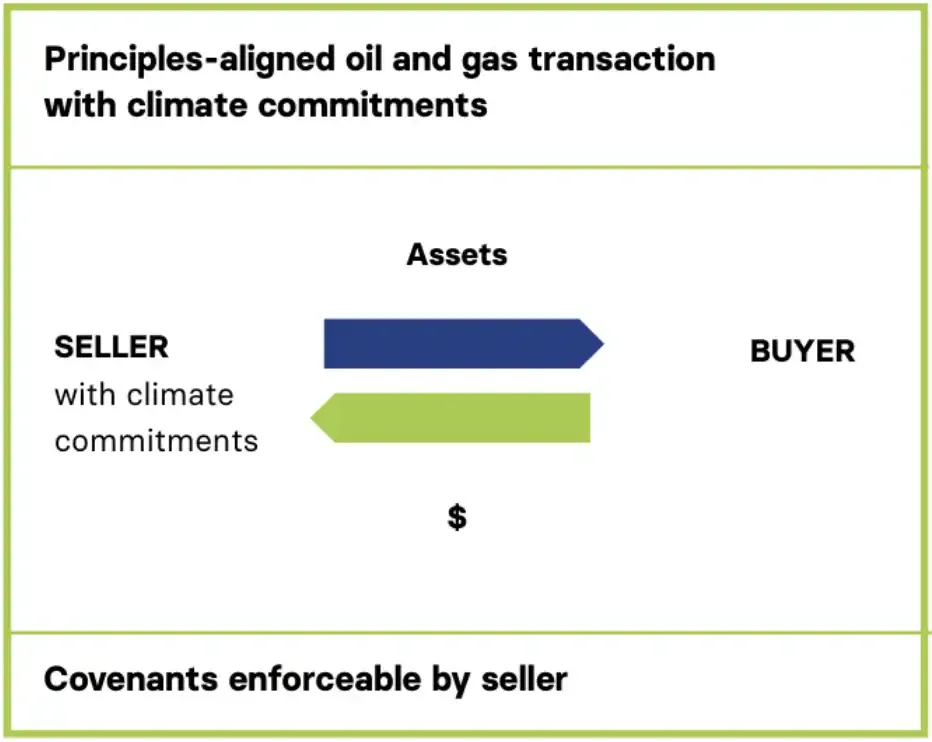

- There are risks and opportunities associated with oil and gas asset transfer. As assets move from companies with strong climate standards and public disclosure requirements to companies without equivalent safeguards, all parties involved are exposed to reputational, legal, physical and transition risk. Maintaining climate standards throughout the transaction creates opportunities to reduce these risks.

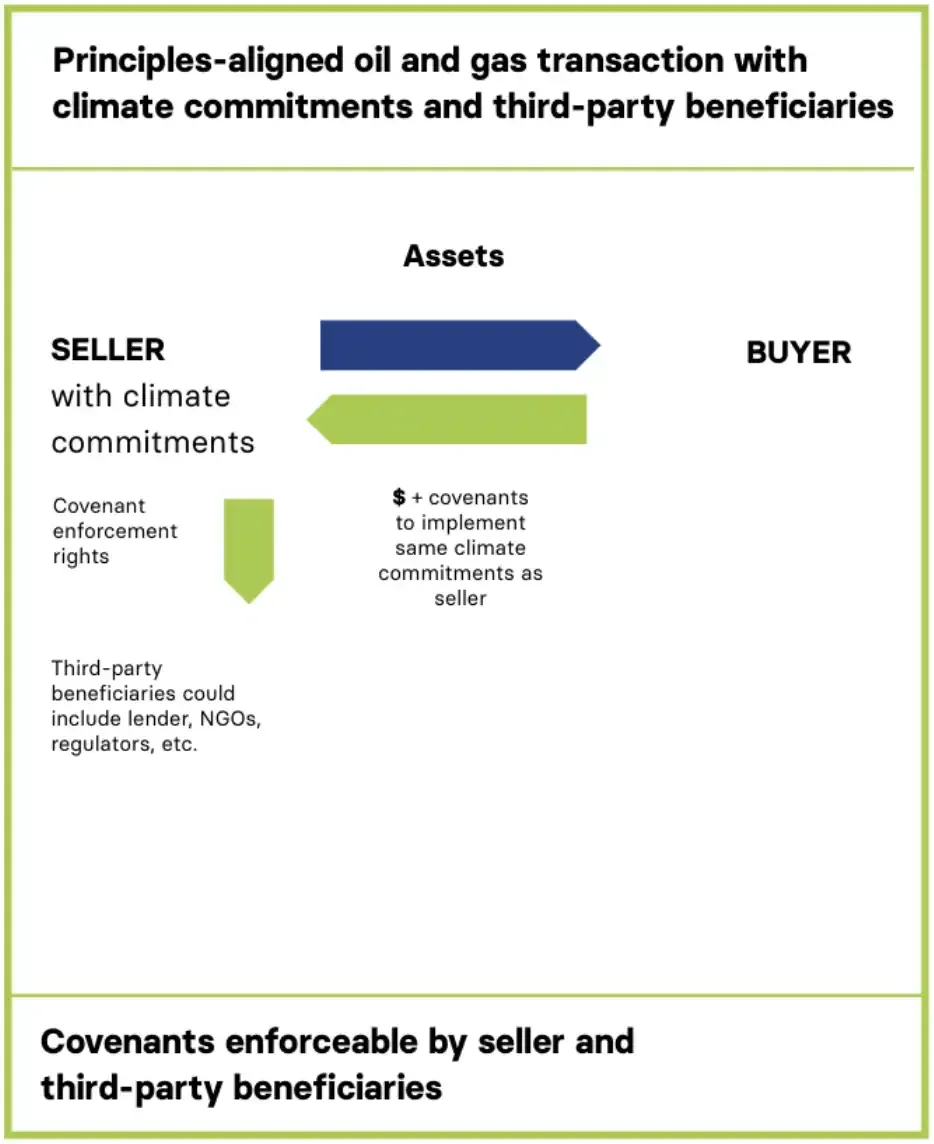

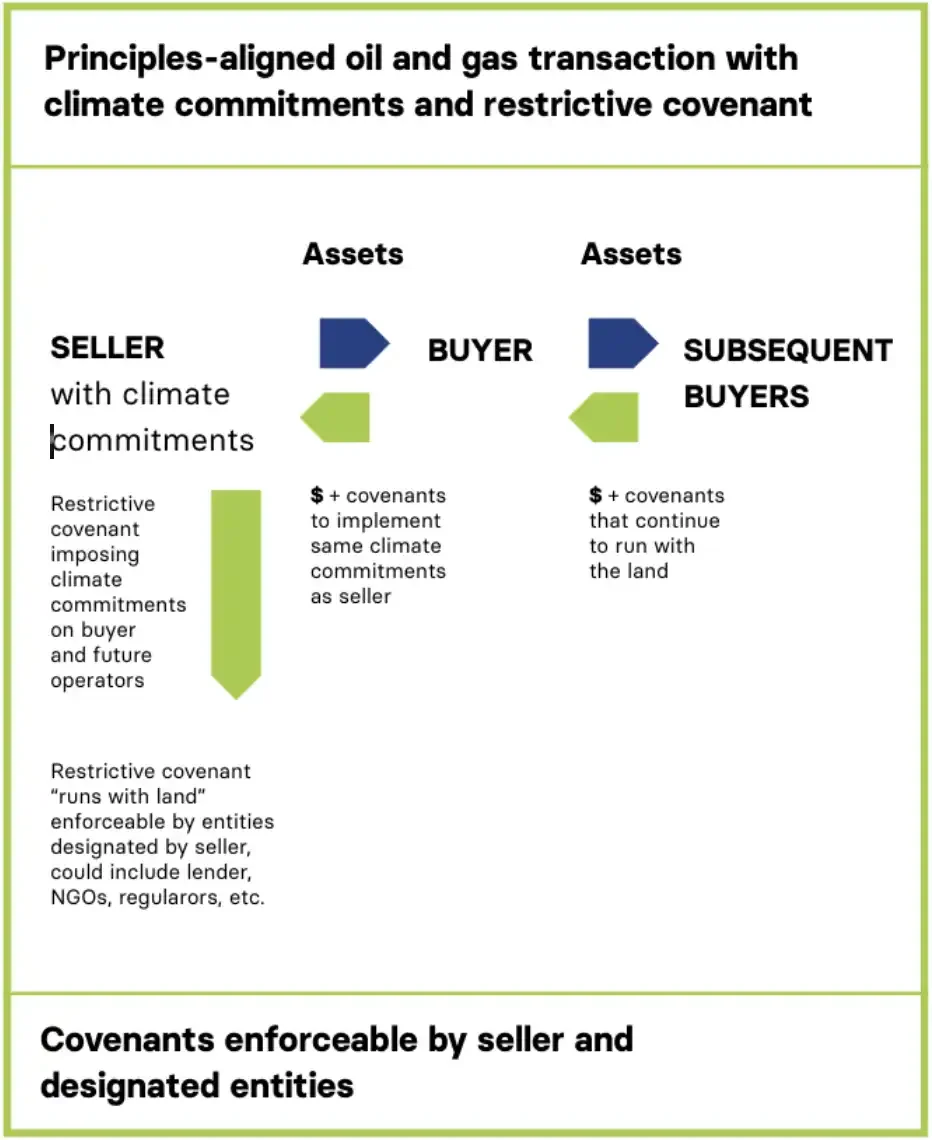

- The Climate Principles for Oil and Gas M&A can help minimize risks for all parties. These Principles ensure that climate commitments transfer along with assets and that the buyer is equipped to responsibly steward the asset.

- Investors should ask companies how M&A activities interact with climate targets and how companies mitigate the climate impact of M&A. In recent years, investors have increasingly made the fiduciary case for M&A stewardship through dialogues with companies and shareholder proposals.

The Climate Principles

For investors, transferred emissions can present financial and reputational risks within their portfolios, and engaging with oil and gas companies and banks on the topic is a strategy to identify and reduce these risks. The discussion, case studies, and examples in this guide can assist investors in engaging oil and gas companies and their bankers to support implementation of the Principles in their own dealmaking.

Levels of Ambition

An investor guide to the climate principles for oil and gas mergers and acquisitions

How investors can engage oil and gas companies and banks on transferred emissions.