- Resources

- With early progress in reducing livestock methane, it’s time for finance to lean in

Resources

With early progress in reducing livestock methane, it’s time for finance to lean in

Published: September 16, 2024 by Andrew Howell

Animal agriculture is the largest anthropogenic source of methane emissions – a major driver of global warming. Reducing methane across the highly varied global livestock industry is not easy, but there are new tools that are starting to show success. Now is the time for the financial sector to engage with food companies and their supply chains to drive action on livestock methane. Our new report delves into the challenges and opportunities of livestock methane from an investor perspective, providing guidance for asset managers, banks, and other financial players looking to understand and address their portfolio risk.

The livestock methane challenge

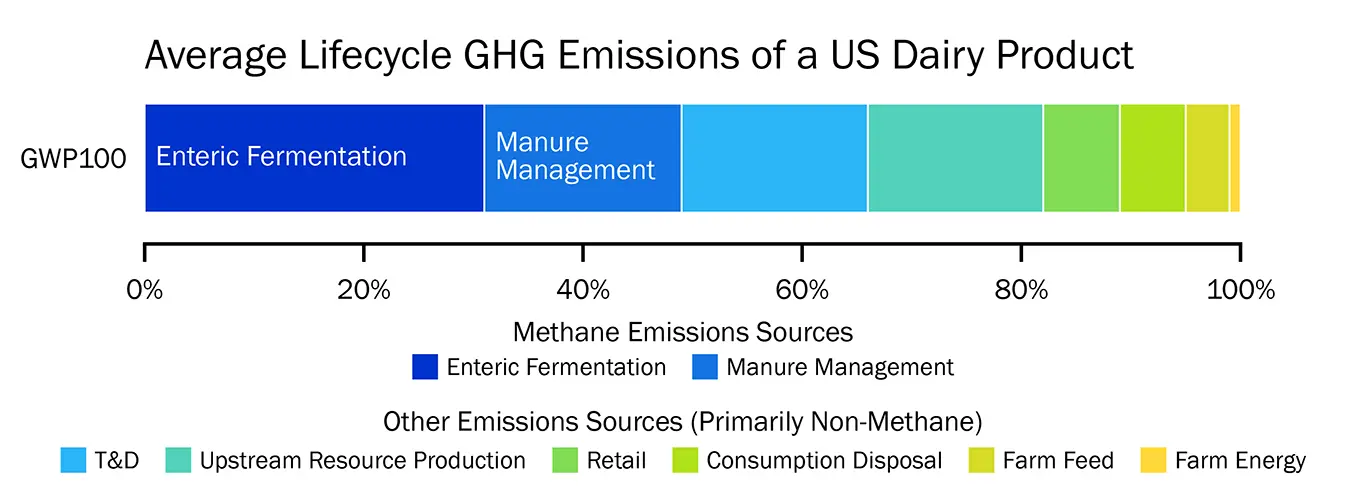

For meat and dairy products sold in the US, a large portion of lifecycle GHG emissions come from methane – in the dairy sector, methane accounts for about half of emissions impacts over a 100-year timescale (below).1 This means that livestock companies cannot reach their net zero targets without getting a handle on the potent greenhouse gas. The approaches for supply chains that include cattle include improving manure management, increasing productivity, and addressing methane from cow burps.

Signs of progress: Commitment and innovation

Leading food and dairy companies have started to signal that they’re paying attention to the methane emissions associated with their products and are looking for ways to reduce them. The launch last year of the Dairy Methane Action Alliance, made up of 8 major industry players, is an exciting step forward for the sector to follow.

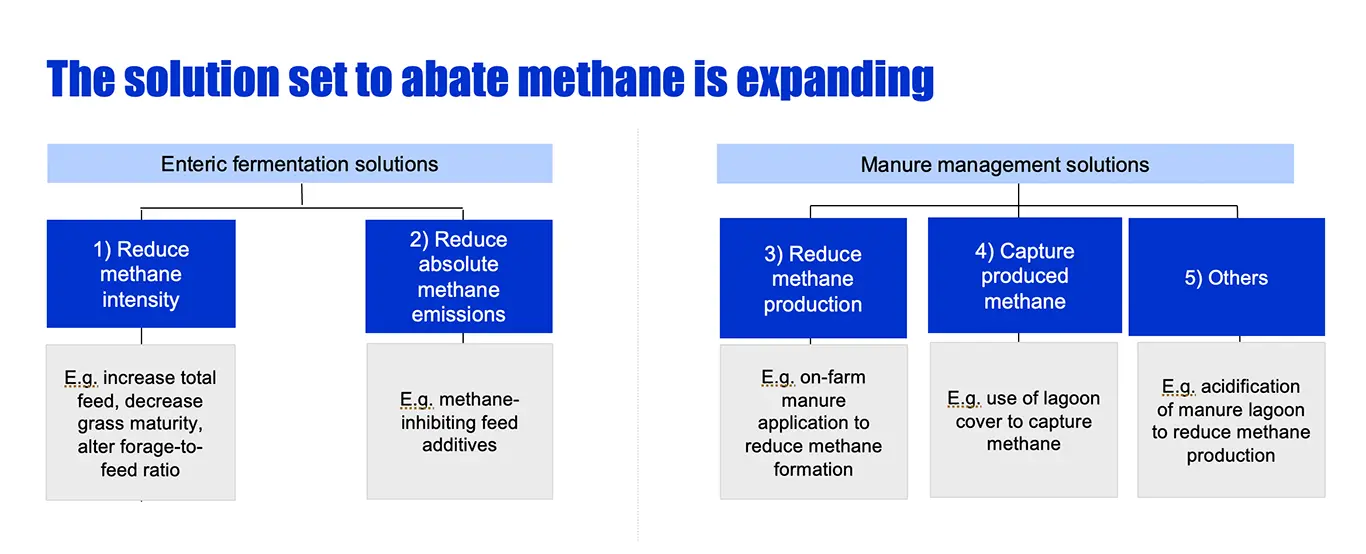

Another sign of progress is the growing portfolio of solutions available to farmers to reduce livestock methane emissions. A recent milestone was the U.S. Food and Drug Administration clearing the way for feed additive Bovaer, developed by dsm-firmenich, to go to market. Bovaer contains 3-nitrooxypropanol (3-NOP), a substance that suppresses the enzyme that generates methane in a cow’s rumen. Bovaer’s studies find that it can reduce methane from dairy and beef cows by up to 30% and 45%, respectively. This feed additive is one of a growing set of solutions – including dietary manipulation, other types of feed additives, and manure management – to help companies cut methane from their supply chains.

Our new investor report dives into key considerations for methane measurement and abatement technologies, summarizes the emerging policy environment for livestock methane, and suggests questions that investors can explore with portfolio companies to assess their exposure to methane risk and progress in managing it.

Measuring and abating livestock methane

A range of modelling tools are available to assist farmers in estimating their methane emissions inventories. Though imperfect, these models are getting better as methane data collection improves.

However, there is a challenge: the data on which the models are based originates with the farmers, who vary in their ability to gather detailed herd and production data. For many food companies, an early focus of methane efforts should be on developing programs to gather methane data from their supply chains. The data can inform new strategies to manage and reduce these emissions.

As investors look to get smart on methane, they should seek input not only from companies themselves, but from the communities in which those companies are situated, to understand any tradeoffs involved in methane mitigation. For example, manure solutions like lagoons require a cover to contain odor and prevent bacteria from spreading. When implemented without such safeguards, they can release air pollutants and trigger health problems in nearby communities.

The finance industry’s role

The finance industry can play a crucial role in accelerating the adoption of methane reduction solutions in the livestock sector. By directing capital towards companies with more advanced methane strategies, investors and lenders can reduce risk associated with methane and identify opportunities for growth.

Providers and facilitators of finance should engage companies with methane exposure by exploring:

- Methane measurement and reporting methodologies;

- Corporate methane reduction action plans;

- R&D spending and supplier incentive programs;

- Collaboration with banking partners to find fit-for-purpose financing solutions;

- Policy positions on methane measurement and reduction;

- For dairy companies, supporting and joining the Dairy Methane Action Alliance to show leadership.

Financial institutions can also look for opportunities linked to methane abatement – like issuing green bonds for methane abatement activities, or writing loans with interest rates linked to the achievement of specific methane reduction targets.

In any industry, understanding the risks and opportunities associated with operational emissions is critical to making informed investment decisions. For food and livestock companies, methane is increasingly coming into focus as a potent climate pollutant for which management tools are available. The finance industry is well equipped to support and accelerate the adoption of methane solutions to drive financial and environmental returns.

__________

1 Methane has a significantly stronger warming potential in the short term, with over 80 times the impact of carbon dioxide over 20 years (GWP20). While GWP100 is widely used for long-term climate planning and GHG accounting, GWP20 emphasizes the urgency to reduce methane emissions, particularly in the livestock sector, where it plays a dominant role. Highlighting GWP20 helps drive faster action to mitigate near-term climate risks.

Livestock methane: A primer for investors

As companies adopt new tools to cut livestock methane emissions, there’s an opportunity for investors to lean in.