- Resources

- From afterthought to accelerator: How insurance can drive the energy transition

Resources

From afterthought to accelerator: How insurance can drive the energy transition

Published: December 4, 2025 by Kate Stein, EDF and Peter Tufano and Jim Matheson, Harvard Business School and Harvard Salata Institute for Climate & Sustainability

Few industries are more underestimated than insurance.

It’s often dismissed as boring or overly complex, and it usually enters the spotlight only when disasters hit and premiums surge. Businesses and homeowners in wildfire- and hurricane-prone areas know this all too well.

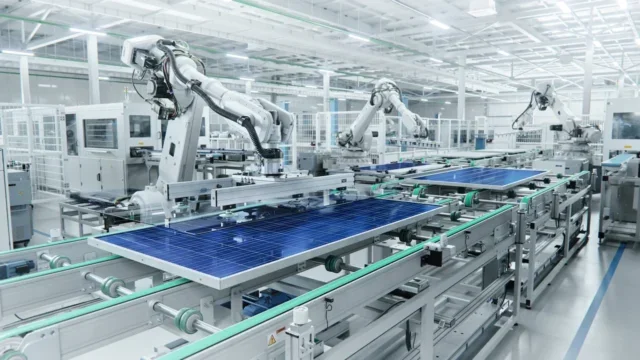

But despite its dowdy reputation, insurance is one of the most powerful — and often overlooked — tools we have for climate action, including emissions reduction. This opportunity was the focus of a working session at Climate Week NYC, cohosted by Environmental Defense Fund and the Harvard Salata Institute for Climate and Sustainability. By reducing real and perceived risks around clean technologies, insurance can help attract the capital needed to accelerate the energy transition.

Why insurance matters

Most people are familiar with insurance through homeowners, renters or health insurance policies. But insurance also underpins the energy economy. Clean energy developers need coverage to construct new projects, protect equipment, manage business interruptions and safely decommission facilities. Their suppliers, lenders and investors carry insurance, too. When insurance works well, it gives each of these parties confidence to take risks, innovate and deploy capital.

This confidence is essential. Many emerging clean technologies — from geothermal and long-duration energy storage to green hydrogen and small modular reactors — face uncertainties that can make investors and lenders skittish. Early-stage companies may have limited operating histories. Data on performance may be scarce. Supply chains may be new or untested. Insurance can’t solve all these challenges, but it can meaningfully reduce or transfer some of the risks that otherwise slow deployment. While the normal capital stack of debt and equity takes on all risks in a prioritized way, insurance can selectively remove specific risks so debt and equity no longer have to carry them.

Creating the conditions for insurance innovation

At Climate Week NYC, EDF and the Salata Institute convened more than 30 energy innovators, capital providers, project developers, insurers, reinsurers and brokers for a first-of-its-kind insurance roundtable that explored how insurers can help to derisk and scale innovative clean energy technologies. Participants in the full-day dialogue identified the most urgent priorities to enable the insuring of such technologies — including boosting insurance literacy among technology providers, improving insurers’ access to technology performance data and piloting innovative risk-transfer tools and insurance strategies — and began charting solutions to turn these ideas into action. Now EDF + Business’s newly hired insurance director and the Salata Institute team will be working with partners from across the ecosystem to dive deeper and collaboratively move these solutions forward.

Five steps to enable insurance innovation that accelerates the energy transition

Download the session summary from Climate Week NYC, to learn how insurers can help to derisk and scale innovative clean energy technologies.

The bottom line

Insurance alone won’t deliver the energy transition. But by reducing uncertainty, increasing investor and lender confidence, and enabling capital to flow, it can accelerate the development and deployment of first-of-a-kind clean technologies. With thoughtful collaboration, better data, and strategic support, insurance can evolve from an afterthought or an annoyance, into a powerful climate solution.

-

Five steps to enable insurance innovation that accelerates the energy transitionView the session summary

-

Actionable Insights for a Decarbonizing WorldExplore the Investor Climate Insights Hub