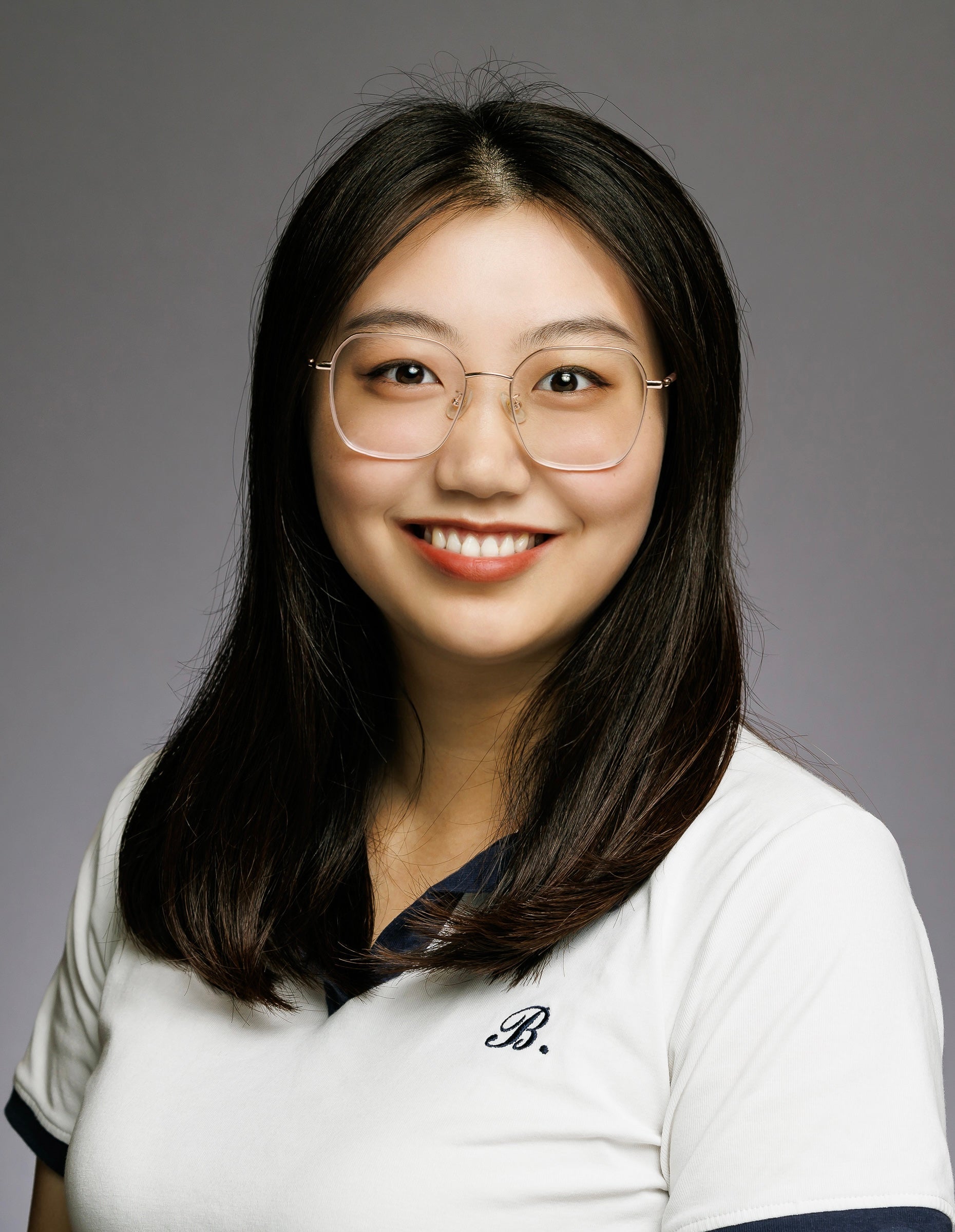

Crestview Partners – Guan Huang – 2024

SummaryGuan Huang supported Crestview Partners’ responsible investing program, with a focus on augmenting the firm’s ESG framework. This included developing a potential red flag checklist for pre-investment assessment, a due diligence template that could be used to evaluate ESG risks and opportunities, and a value creation guide that could be used post-investment.GoalsCrestview Partners, a value-oriented private equity firm focused on the media, industrials, and financial services sectors, applies its responsible investment approach from pre-investment through the hold period. Guan’s fellowship aimed to develop tools that could be integrated into the investment assessment and diligence processes as well as support value creation initiatives during ownership.SolutionsGuan executed the project through a structured, three-phase approach:

1. Red Flag Checklist for Investment Assessment: Conducted a materiality analysis across Crestview’s three core sectors, identifying potential key red-flag indicators that could help inform pre-investment assessments.

2. Due Diligence Template for ESG Evaluation: Developed a value-focused due diligence template featuring quantitative scorecards that could be used to evaluate a target company’s exposure to ESG risks and opportunities, and management capacity, prioritizing material issues for Crestview’s investment teams.

3. Value Creation Guide for Portfolio Companies: Provided a detailed guide with actionable items tailored to address material ESG issues, offering both potential short- and long-term initiatives, along with quantitative KPIs to monitor progress over the hold period.Potential ImpactGuan’s framework has the potential to enhance Crestview’s diligence and investment evaluation process, as well as the ESG practices of its portfolio companies. By leveraging this ESG framework, Crestview can identify key sustainability levers, develop targeted ESG initiatives for portfolio companies, and effectively monitor and support progress throughout the ownership period.