- Resources

- Fostering innovative finance in the agriculture value chain

Resources

Fostering innovative finance in the agriculture value chain

Published: February 4, 2022 by EDF Staff

Companies throughout the agriculture value chain have set commitments to reduce the environmental impacts of agricultural production. They’re now engaged in the hard work to achieve those goals by developing programs to increase farmer adoption of conservation practices.

As value chain sustainability programs mature, there is increasing attention on the financial barriers to the implementation of sustainable agriculture at scale — and questions about how financial innovation can overcome those barriers.

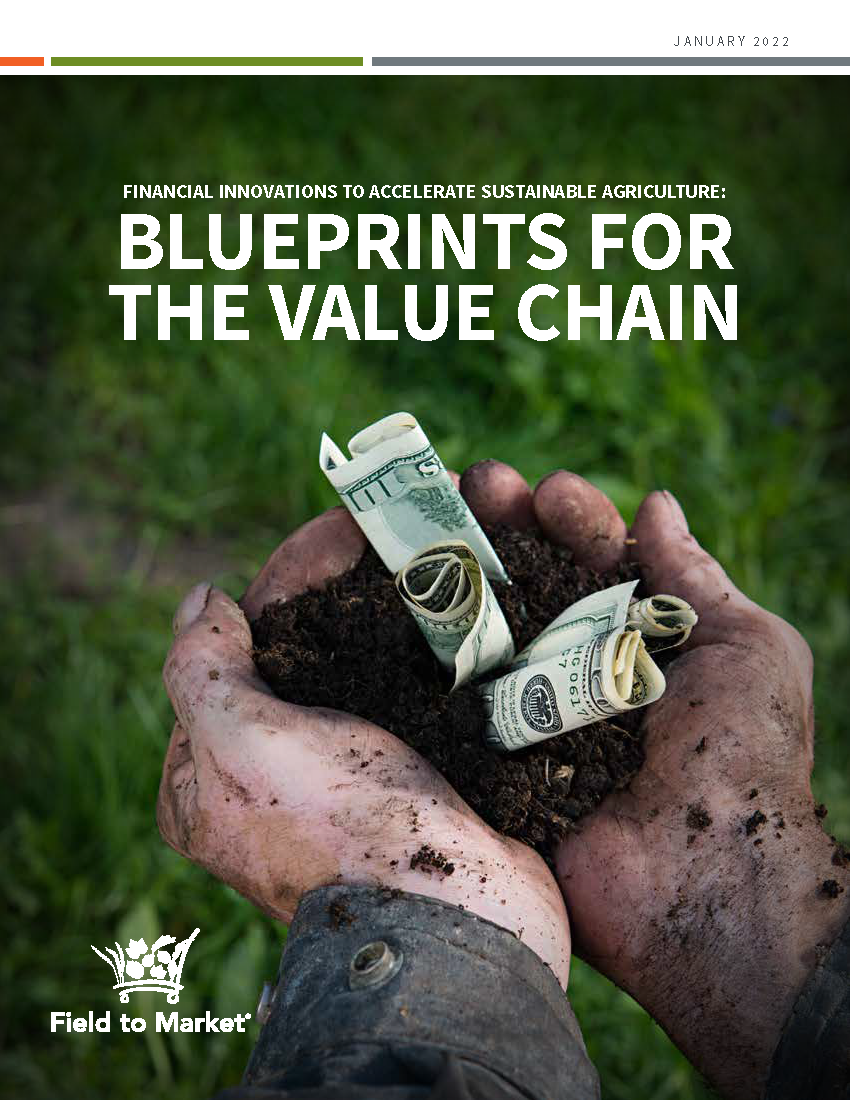

A recently released report, Financial Innovations to Accelerate Sustainable Agriculture: Blueprints for the Value Chain, provides companies throughout the food and agriculture sector with 12 tangible innovative finance mechanisms and value-added incentive strategies to support U.S. farmers in scaling conservation practices and delivering sustainable outcomes. The blueprints encompass innovations for transition risk sharing, pay for performance, leasing incentives and more.

The report is a product of a year-long effort by Field to Market’s Innovative Finance Workgroup, co-chaired by Environmental Defense Fund and the American Farm Bureau Federation. The workgroup consists of 21 representatives from value chain companies, producer organizations, civil sector groups and academic institutions, all of whom gathered once a month throughout 2021 to learn about financial innovations and discuss how each could support farmers in overcoming barriers to conservation adoption.

Here are three key insights for those looking to take action.

1. Start with the problem you are trying to solve

There are many financial barriers to conservation adoption, which can be further complicated by additional operational and cultural barriers to change. Those who wish to advance innovative financial incentives must recognize that there is no single approach that will overcome the diversity of barriers faced by farmers, and they need to carefully match their chosen financial incentive(s) to specific barriers.

The workgroup frequently returned to a grounding question: What problem are you trying to solve? Some of the financial barriers discussed include upfront costs, inflexible capital, lack of return on investment, and the risks of yield loss or increased costs during the transition.

The report matches each financial innovation with the barriers it can address, which helps to narrow the set of possible interventions to those best suited to the identified problem.

2. Learn from the innovators

The level of interest and experimentation in this space is frankly inspiring. It can also be difficult to keep up with, which was a main reason that the workgroup decided to develop the blueprints contained in the report.

Each of the 12 blueprints follows a common format to allow for easy comparison and includes examples of leading innovators or projects that can be learned from. The blueprints are also mapped along a continuum that includes those that will require a longer time horizon to develop, those that are currently being developed and piloted, those that are ready to scale, and those that are broadly available. This actionable information is designed spur greater collaboration and investment.

3. Use your unique interests, strengths and relationships to drive progress

Shifting the agricultural system toward one that supports the livelihoods of a diverse array of farmers, while minimizing environmental impacts, is a complex challenge that can’t be solved by any individual company or organization. At the same time, each organization in the value chain has a unique set of interests, strengths and relationships that it can bring to this challenge.

This report showcases the different ways in which value chain actors are leveraging innovative finance, whether by purchasing environmental outcomes directly, subsidizing risk-sharing mechanisms for farmer suppliers, or collaborating with financial institutions to design bonds and loans that support them in achieving their sustainability goals.

The opportunity to re-align financial signals and incentives throughout the agriculture financial system is great. The promise lies in bridging the knowledge and financing gap so that farmers, value chain actors and investors understand the risks and returns of conservation adoption, and embrace solutions that overcome barriers and maximize benefits. This report is a valuable resource for any organization interested in engaging in this journey.

Our Experts

-

Financial Solutions for Agricultural ResilienceLearn More