- Resources

- An innovative agricultural loan is oversubscribed. Here's what we learned from the farmers who signed up.

Resources

An innovative agricultural loan is oversubscribed. Here's what we learned from the farmers who signed up.

Published: April 21, 2022 by EDF Staff

In January, Farmers Business Network®, a global farmer-to-farmer network and ag tech company, launched a new rebate program for farm operating loans that includes a lower interest rate for farmers who achieve climate and water quality benchmarks created by Environmental Defense Fund. By mid-March, the initial $25-million pilot fund was full, with 48 farmers enrolled and a growing waitlist to participate in an expanded fund.

Farmers are currently feeling the financial crunch of inputs, with year-on-year prices for nitrogen-based fertilizer in the U.S. up nearly 100%. At the same time, farmers are facing rising interest rates on loans.

The FBN® Regenerative Agriculture Rebate Program is a particularly attractive option for farmers in light of these economic pressures. It offers support for farmers in optimizing their nitrogen use to reduce fertilizer costs while maintaining crop yields, and also provides a 0.5% interest rate reduction from the farmers’ base rate if they meet environmental standards.

The pilot year will allow FBN to connect farm environmental performance with the financial performance of the fund, and allow EDF to quantify climate and water quality outcomes using aggregate data. It will also allow other farm lenders to learn from our experience.

Here’s what we learned from the farmer enrollment period.

How farmers were selected

To determine interested farmers’ eligibility for the loan, FBN assessed both their credit worthiness and whether they meet the environmental standards required to receive the interest rate discount.

Farmers could currently be meeting the environmental standards or have a plan to improve their farming practices to meet the standards this year. The standards require evidence of soil sampling in one of the last four years, one or more soil conservation practices such as no-till or cover crops, and field-level nutrient management within a safe zone that minimizes nitrogen loss as measured by the N balance metric.

Diverse farm sizes and geographies

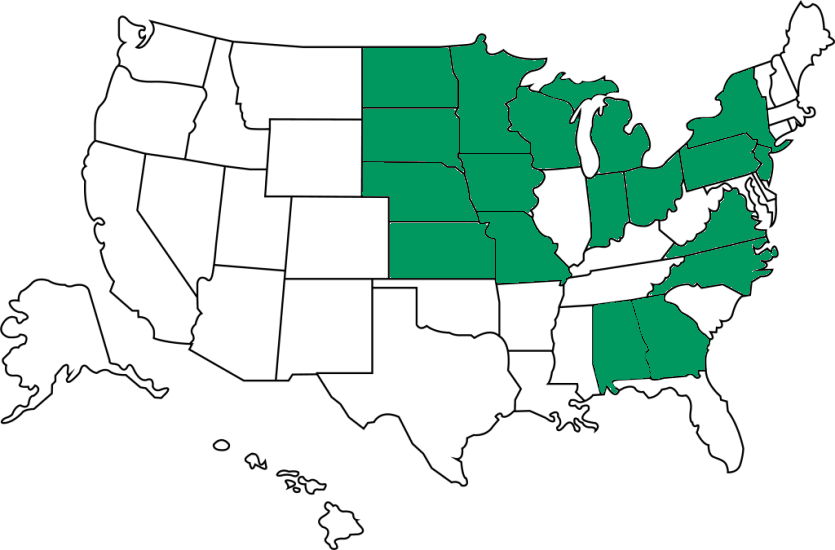

FBN marketed the loan to corn, soy and wheat farmers across the country, and the initial cohort of farmers shows substantial diversity in farm geography and size.

The loan fund enrolled farmers from 18 states. The highest numbers of enrolled farmers came from Iowa, followed by North Dakota. Combined, those states account for 42% of the total number of enrolled farmers.

The size of the loans made as part of the pilot fund range from under $100,000 to over $2 million, with an average loan size of $500,000. The average size of the enrolled farms is over 2,000 acres, with farms under 500 and over 7,000 acres participating.

The initial enrollment in the FBN loan fund is a great endorsement of farmer interest in loan products that reward environmental performance across a wide range of farm sizes and locations.

What’s next for the farmers and the fund

The farmers who enrolled in the pilot fund are now able to draw against their loan for expenses such as seeds and fertilizer. Prior to planting, they will do a full data upload of three years of historical data to FBN’s Gradable™ data platform. Gradable triangulates claims for farms, validating practices at the field level through remote sensing and using machine learning algorithms to compare field-level results against the performance of millions of acres of farms in the network.

Each farm that meets the environmental standards will receive a rebate for 0.5% of the interest on their operating loan after harvest. If a farmer is unable to meet the environmental standards, they won’t receive the rebate but will still have their underlying financing from FBN.

With the initial pilot underway, FBN plans to scale the fund to $500 million over three years and access public markets to securitize and sell these loans to investors seeking liquid, environmentally friendly investments. The results of this pilot can also inform other agricultural lenders who want to work with their farmer clients to build long-term resilience and profitability for both farms and agricultural loan portfolios.

View webinar

Our Experts

-

Financial Solutions for Agricultural ResilienceLearn more