Coal: A crucial methane opportunity

By Leanna Tang and Andrew Howell, CFA

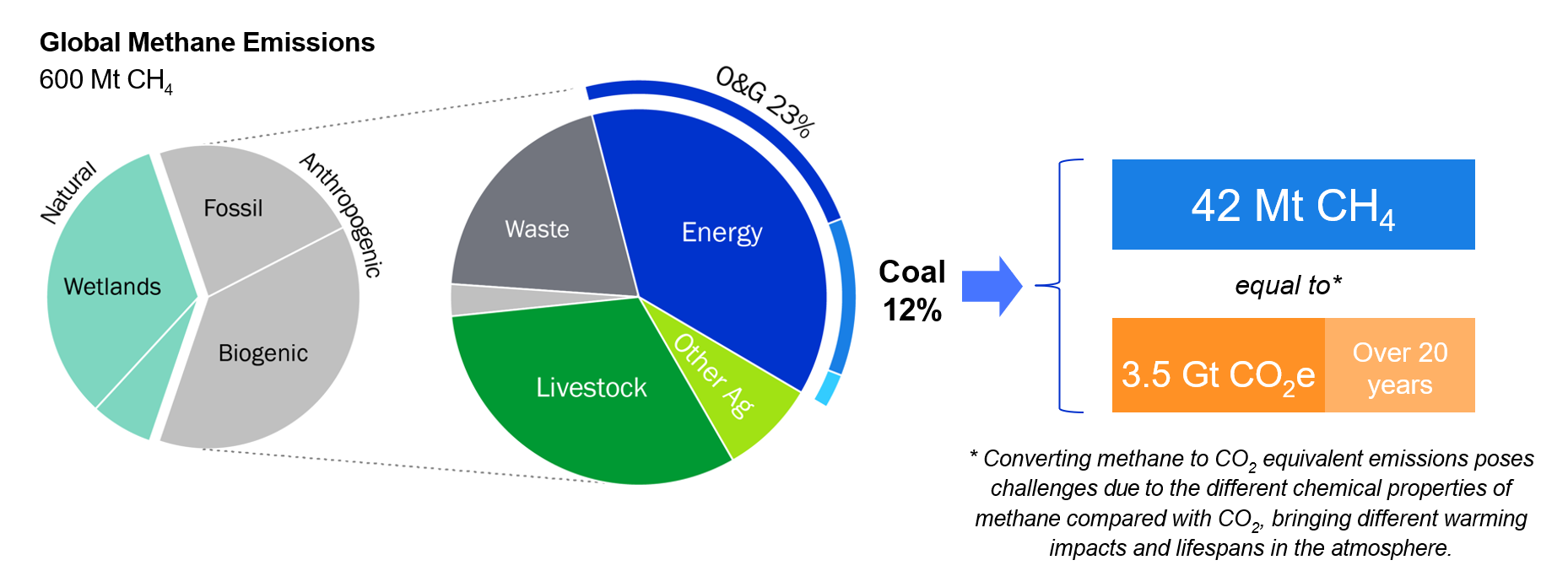

Methane emissions have recently come into focus as a major contributor to global warming. From the Global Methane Pledge announced at COP26, to the Oil and Gas Decarbonization Charter announced two years later, policymakers and industries are paying greater attention to the urgency of cutting methane emissions in oil and gas. Significant advances in methane measurement and abatement could serve as useful tools as we turn our sights to the second largest source of methane from the energy sector: coal.

Coal mine methane (CMM) — emitted during the mining process when methane trapped within coal seams is released — is estimated to be 42 million tonnes per year, according to the IEA, about half the amount emitted by the oil and gas sector. This has the carbon dioxide equivalent (CO2e) warming impact of 3.5 Gt of CO2 over 20 years, equal to the emissions produced by 730 million passenger cars in a year.

Despite this significant climate impact, CMM has attracted limited attention from companies, policymakers, and the financial community to date. In a new presentation for the financial community, Coal Mine Methane: An Overview for Investors, we show that improving the management of CMM can be an effective and relatively low-cost way to reduce greenhouse gas (GHG) emissions. According to the IEA, around 90% of abatable CMM emissions could be eliminated at or below $20 per ton of CO2e, when measuring the warming potential of methane over 100 years. Thus, addressing CMM can be an important tool for investors to manage climate risk in their portfolios and achieve sustainability goals.

Methane is a significant contributor to steel emissions

Methane from coal mining is a relevant climate risk factor for the steel sector, where a key input is metallurgical (met) coal. Met coal is more methane-intensive than thermal coal, containing about 2.5 times more methane on average. These emissions are often overlooked but significant: accounting for CMM leads to a ~30% increase in the lifecycle emissions of a ton of steel over a 20-year period, on average when using conventional steelmaking processes.1 While transitioning to green steel processes that do not use met coal is an important goal of the energy transition, this will take time. In the near term, methane abatement can be a cost-effective way to reduce steel’s climate impact.

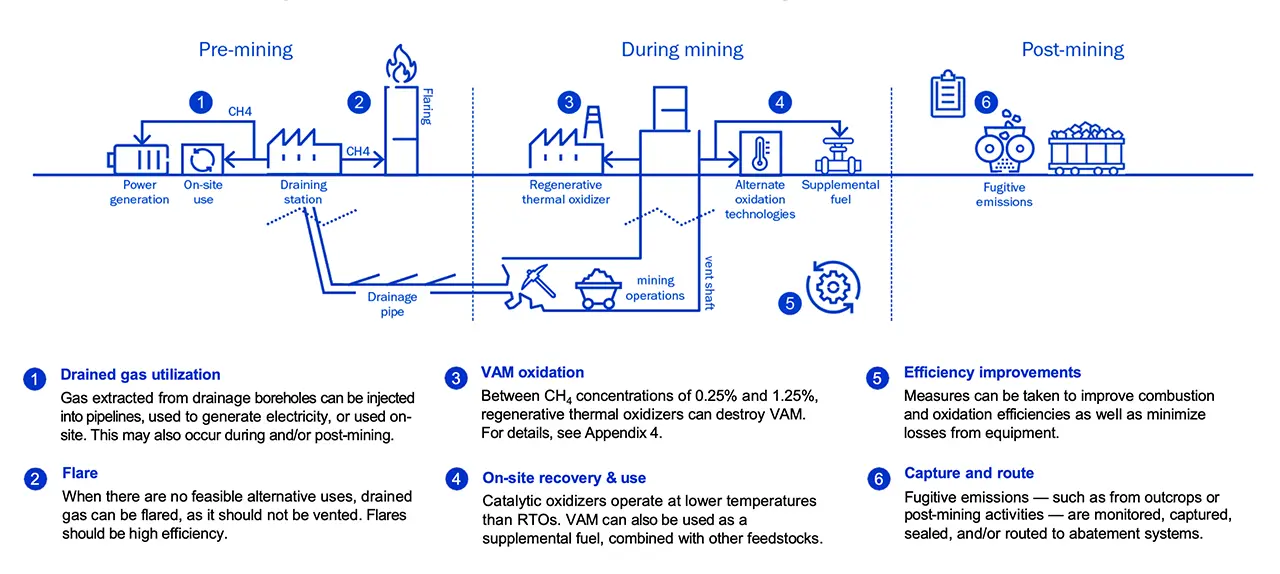

Coal mine methane generally occurs in two common forms that can be managed using different abatement technologies. Ventilation air methane (VAM) is methane from underground mines that has been diluted to safe levels by mine ventilation systems and then released into the atmosphere. VAM is low in concentration but likely accounts for a majority of CMM emissions; it can be destroyed using regenerative thermal or catalytic oxidizers. In contrast, drained methane is extracted from coal seams prior to or during mining operations and recovered in much higher concentrations than VAM. Drained methane can be captured and used for power generation or pipeline injection, though it is often flared or vented instead.

The mining industry needs more incentives to capture methane

Although CMM abatement technologies are mature and well understood, coal mines generally release most CMM because that is the lowest cost approach. Here, there is an opportunity for steel companies procuring met coal to provide financing and incentives for CMM management, ultimately reducing the GHG intensity of their products and providing a competitive advantage as the industry decarbonizes. Carbon markets represent another possible pathway for financing, as CMM abatement measures can be used to generate carbon credits under certain mechanisms. Finally, policy also has an important role to play: CMM policies in major coal-producing countries such as China, Australia, and the United States should evolve to discourage CMM emissions.

There are signs that international focus on this issue is growing. In 2022, several large economies signed the Joint Declaration from Energy Importers and Exporters on Reducing Greenhouse Gas Emissions from Fossil Fuels, which included specific provisions addressing CMM. At last year’s COP28 in the UAE, the Steel Standards Principles contained the first global acknowledgement of methane’s importance to the steel industry. Most recently, momentum has been building towards an international framework addressing CMM — with a focus on metallurgical coal due to its significance to the steel industry — in the form of the Steel Methane Programme, supported by UNEP’s International Methane Emissions Observatory (IMEO).

With attention to CMM on the rise, investors should assess portfolio exposure

As evolving initiatives put a greater spotlight on coal methane, the financial community can take critical steps to engage coal mining and steel companies on CMM and encourage steps to manage this source of climate risk. To date, most mining and steel companies have provided limited to no disclosures or commitments on this issue; investors and lenders should start asking for these. Mergers and acquisitions in the global coal mining sector provide another opportunity for engagement, given the flurry of recent M&A activity.

A decade ago, oil and gas methane was understood to be a challenge, but actions to address it were stymied by a lack of data, policy, abatement solutions, and attention. Since then, companies have made significant progress thanks in part to engagement by the financial sector. It is time for the coal and steel industries to tackle their own methane challenge.

______________________

1Kasprzak et al., in preparation.