Activating National Oil Companies for Climate Progress: Financial Strategies to Cut Methane Pollution

Financial Strategies to Cut Methane Pollution

Methane is a powerful greenhouse gas, responsible for more than one quarter of the warming we are experiencing today, and global oil and gas production is a major source of methane emissions. Reducing oil and gas methane emissions is a crucial and practical means to quickly slow the rate of global warming, even as we fully decarbonize our energy systems.

After more than a decade of science-backed public, regulator, and investor pressure, all seven global supermajors and many public and private energy companies have begun to take action on improving their methane management.

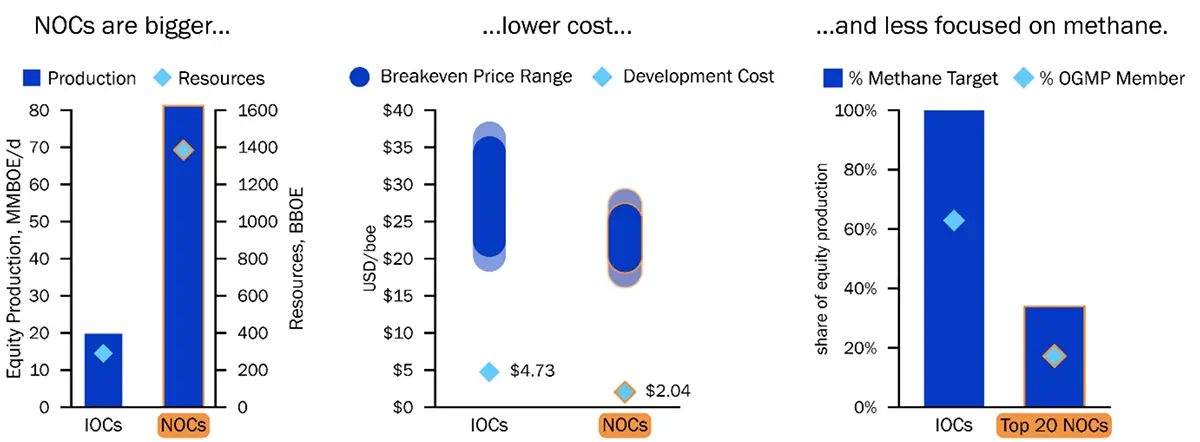

National oil companies (NOCs) produce more than half of global oil and gas supplies, but the vast majority are not effectively managing their methane emissions.

Reducing oil and gas methane emissions is a crucial and practical means to quickly slow the rate of global warming, even as we fully decarbonize our energy systems.

NOCs are essential for tackling emissions

As NOCs play catch-up in the race to curb methane pollution, the finance sector has an important role to play because methane emissions present a material risk to national oil companies, their host governments, and their financial stakeholders.

In tackling the issue, NOCs can access extensive resources within the industry and outside of it. For example, companies can join the Oil and Gas Methane Partnership 2.0 (OGMP 2.0), which represents more than 40% of global oil and gas production. Joint venture partners, banks, and investors are also potential resources, and many of them have climate targets that extend to the companies that they fund or transact with.

19

of the top 20 publicly traded companies have set methane targets.

8

of the top 20 NOCs have set methane targets.

Tools for NOC methane abatement

The pathways for NOCs to reduce methane emissions borrow heavily from learnings by their private sector and publicly traded peers and include four key steps.

1

Measure methane emissions

Despite the availability of a diverse and increasingly affordable portfolio of measurement solutions, too many companies rely on desk-based methods to estimate methane emissions. The most credible way to get on this path is to join OGMP 2.0, which lays out a pathway to using direct methane measurement to target emission reductions.

2

Set ambitious methane reduction targets

These should align with the methane intensity targets set by OGMP 2.0, of 0.2% methane intensity by 2025 or near-zero methane emissions by 2030. As of now, just eight of the top 20 NOCs have set measurement-based methane targets through OGMP 2.0.

3

Operationalize methane reduction targets

This means allocating capital and technical resources and aligning management incentives towards meeting methane goals. Financial parties should help NOCs access and best utilize capital towards accelerating methane management.

4

Collaborate for methane mitigation

Large, well-resourced companies with more experience in methane mitigation should assist their less-resourced peers to get on track, especially when they share joint ventures.

Resources

Environmental Defense Fund Energy Finance Experts

Andrew Baxter

Senior Director, Energy Transition

Environmental Defense Fund

Andrew Howell

Senior Director, Sustainable Finance

Environmental Defense Fund

Dominic Watson

Senior Manager, Energy Transition

Environmental Defense Fund

Sudhanshu Mathur

Energy Analyst

Environmental Defense Fund

Media Contact

Negin Janati

In the news

Oil companies expand methane detection campaign in emerging economies

Financial Times

New satellite to track methane gas leaks

Marketplace

Oil companies sign onto big climate deals to cut potent greenhouse gas

Washington Post

Big oil’s dirty secret in Iraq

Unearthed