Ratio Rundown: Unpacking banking’s newest climate metric

Ratio Rundown: Unpacking banking's newest climate metric

As banks navigate the changing landscape of climate-related disclosures, a new metric – the energy supply finance ratio – merits a closer look.

Introduction

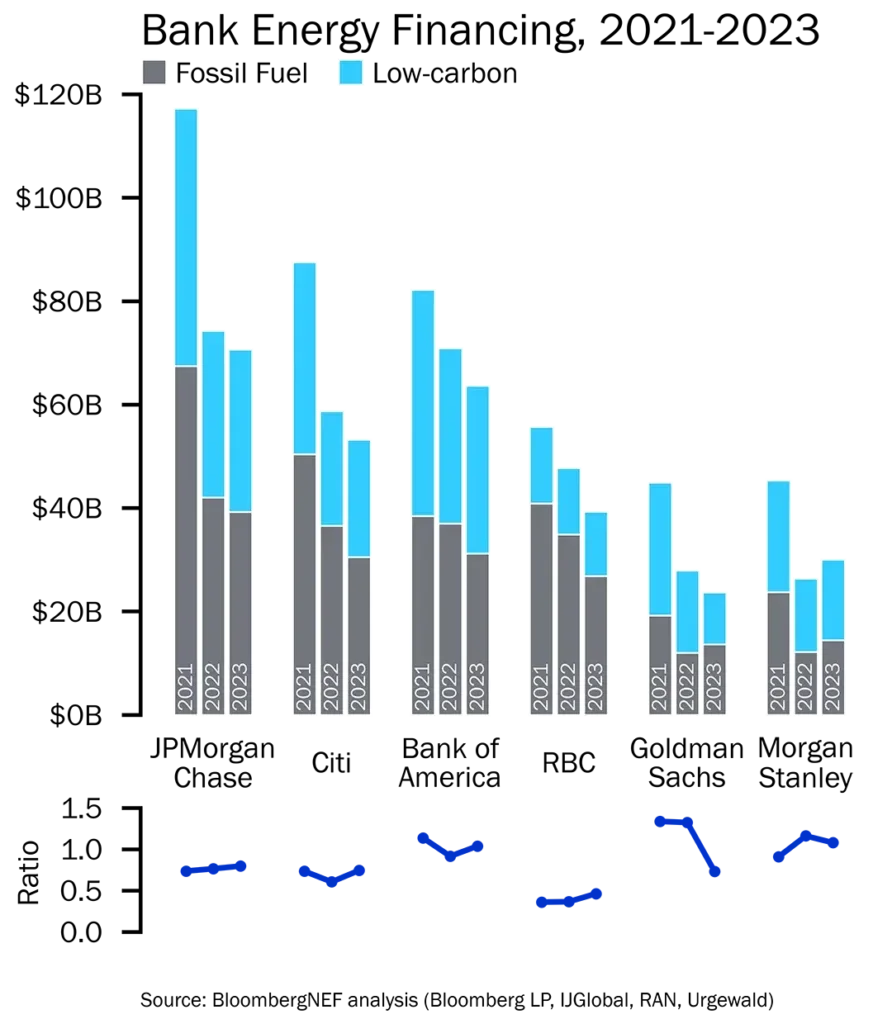

Banks play a central role in economic activity, and as such they are important players in the energy transition. However, the banking sector has struggled to develop metrics that show how their financing activities align with a clean energy transition.

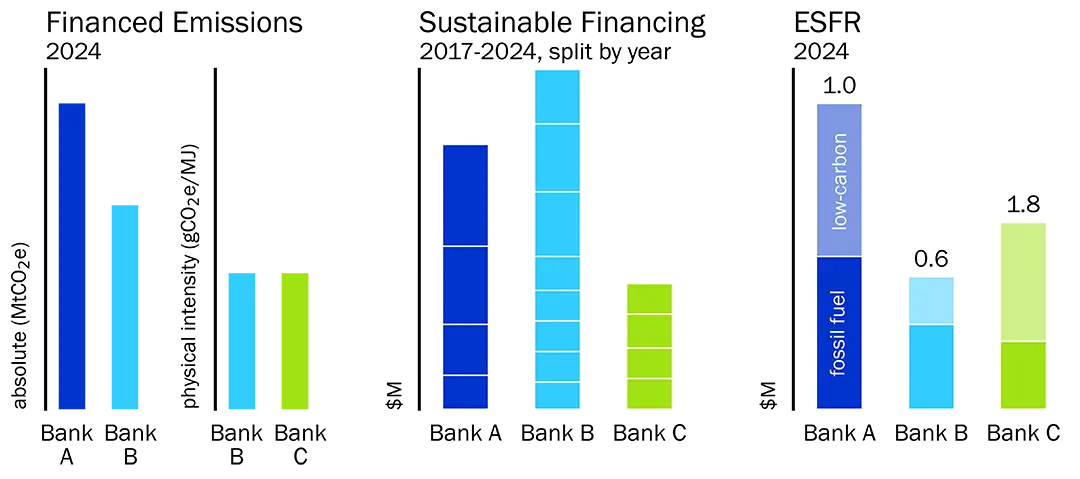

Bloomberg New Energy Finance has developed a metric called the Energy Supply Finance Ratio (ESFR) with the goal of clarifying the link between financing and the energy transition. Put simply, the ESFR is the ratio of a bank’s financing of low-carbon energy production to its financing of fossil fuel energy production. A bank with an ESFR ratio close to 1 invests equally in low-carbon and fossil energy; a bank with a lower ESFR invests mainly in fossil energy sources, while a higher ESFR indicates more active financing of clean energy solutions.

Here we use dummy data to demonstrate differing and sometimes conflicting information across the three main metrics reported by the major U.S. banks.

- Bank A is a large bank with high overall financing to both low-carbon and oil and gas clients. It reports high absolute financed emissions, and its significant financing for oil and gas is matched with a similar level of financing for low-carbon energy.

- Bank B is smaller, with less energy sector financing overall. Bank B provides more financing to the oil and gas sector than to low-carbon energy, but because it has a smaller energy sector portfolio overall, its absolute financed emissions are lower. Bank B’s sustainable financing target includes investments back to 2017.

- Bank C is a medium-sized bank that prioritizes low-carbon energy supply finance. It doesn’t report absolute financed emissions, however it has the same financed emissions intensity as Bank B because its smaller portfolio of oil and gas assets has the same emissions intensity as those of Bank B. Bank C finances more low-carbon energy than Bank A or B, but its sustainable finance target is more narrowly defined than its peers, making it appear less ambitious.

The ESFR aims to address certain problems with the other two main sustainability metrics for US banks – financed emissions and sustainable finance. It improves on each in certain ways, but also has its own drawbacks.

- There is no single, accepted way to calculate the ESFR. Bloomberg proposed a method to devise the new metric, but banks are not bound to follow it.

- Banks need to designate financing activities as “low carbon” or “fossil fuel”, which can result in judgement calls. For example, a bank may categorize a general-purpose loan to a company that operates both low-carbon and fossil fuel technologies as “fossil fuel financing” because the company earns most of its revenue from fossil fuel operations, or divide it across both categories based on the company’s capital expenditure or revenue.

- Banks must determine which financing and facilitation activities to count in the metric and what data to use for them. Calculating based on proprietary bank data can increase accuracy and relevance of the metric for the bank itself, while using publicly accessible data allows for greater transparency, comparability, and replicability.

Conclusion

To improve the utility of this growing information ecosystem, banks should disclose how climate data fits into their broader climate risk strategy, providing sufficient transparency to compare climate strategies between banks even if information gaps persist within individual metrics. Banks should report the ESFR and should include in those disclosures the underlying calculations for both absolute fossil fuel energy supply finance and absolute low-carbon energy supply finance.

Additional Resources

Report

Carbon Conundrum: The Curious Case of Financed Emissions

Big banks have made progress in setting climate commitments, but disclosure of their oil & gas portfolio emissions are inconsistent and unclear.

Read More

Report

Missing Methane: The decarbonization risks and opportunities of financed methane emissions

Financed emissions reporting by the six biggest US banks doesn’t show if they’re improving. Focusing on methane can yield results.

Read More

Blog

Investors, bipartisan former officials, others defend SEC climate risk disclosure rule

The Securities and Exchange Commission (SEC) recently adopted a rule to better equip investors to manage climate change risks.

Read More

Blog

Transition finance for net zero is lagging. The UK has an opportunity to lead, but appropriate guardrails are needed

UK TFMR Secretariat has an opportunity to develop strong market standards to channel private finance towards real world decarbonisation.

Read More

Report

Missing Methane: A European perspective

European banks face significant risk from oil and gas methane emissions in their portfolios. Our recommendations can help banks manage them.

Read More

Report

Financing Methane Abatement: An introduction to sustainable finance instruments

Creating the right financial instruments can enable cash-constrained national oil companies to pursue rapid oil and gas methane abatement.

Read More