ExxonMobil at a crossroads: A mega-merger in the Permian threatens U.S. methane action

By Dominic Watson and Sudhanshu Mathur

ExxonMobil is at a crossroads. Flush with cash, the company is reported to be eyeing an acquisition of Pioneer Natural Resources, the third-largest oil producer in the booming Permian Basin. Meanwhile, under pressure for its environmental performance, the company faces a shareholder resolution calling for improved disclosure of its greenhouse gas emissions.

Acquiring Pioneer would give Exxon a dominant position in a region known for low-cost production. But what has been largely overlooked is how the nearly $50 billion deal could undermine growing progress in managing oil and gas industry methane emissions – an area where Pioneer has made industry-leading commitments but where Exxon has fallen short.

Exxon now faces a choice: double down on old, dirty ways of doing business, or use this acquisition to demonstrate to its investors that it is serious about its decarbonization efforts.

A backward step on transparency

If an Exxon-Pioneer deal goes through, nearly 300 million barrels of oil equivalent annually would no longer be covered by Pioneer’s industry-leading methane management and reporting commitments and would likely revert to Exxon’s own outdated and inadequate practices.

Pioneer has committed to credibly measure, report and reduce its emissions through the Oil and Gas Methane Partnership (OGMP). But Exxon continues to rely on emission factors for methane reporting and mitigation, even as these antiquated desktop based estimates have been shown to consistently undercount emissions and regularly miss major leaks.

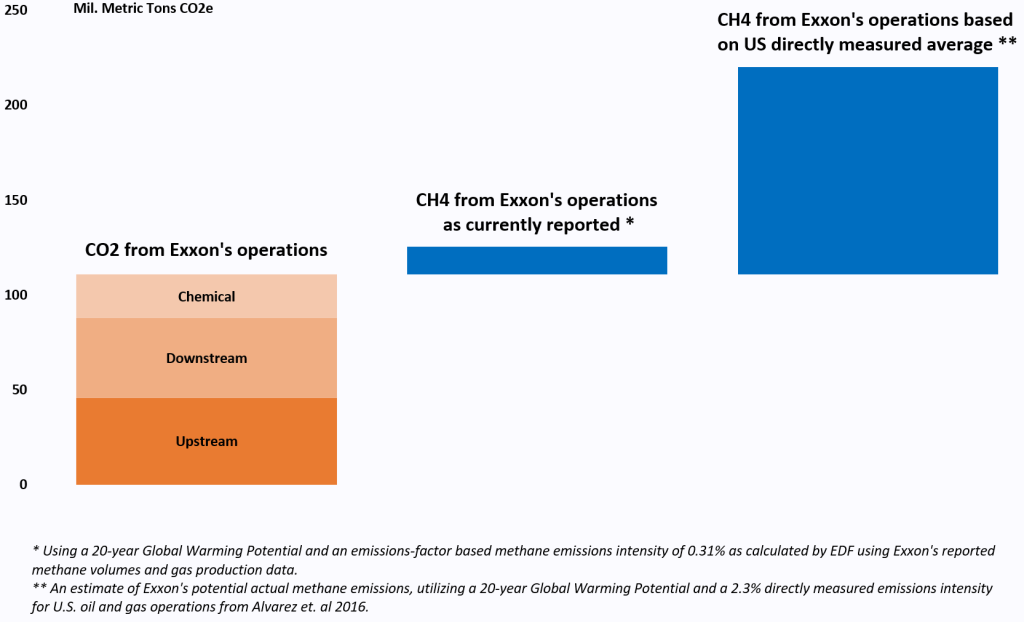

Exxon says its current estimation practices are sufficient. But studies using direct emission measurement repeatedly show that emission factors significantly underestimate and misattribute emissions. While there is evidence to show that Exxon has made progress in reducing methane emissions in the Permian basin, which represents 15% of Exxon’s production, the study only covered super emitters and does not speak to emissions trends from the remainder of Exxon’s portfolio. As shown by the chart below, if Exxon’s operational emissions are at the U.S. average, they could be underreported by a factor of six.

Basing long-term emission reduction strategies on faulty data not only threatens the company’s ability to accurately report progress, it ultimately undermines the company’s ability to achieve emission reductions. Simply put, you can’t manage what you don’t measure. That’s why the OGMP framework is built from the ground up to address this issue and includes protocols that provide companies with the data they need to address real-world emissions, not paper ones.

Exxon is lagging behind its peers, global standards

Exxon has actively pushed back against calls for a robust and transparent methane management plan – most recently by opposing a methane data quality shareholder resolution. When a nearly identical resolution was filed at Chevron last year, it received the support of 98% of Chevron’s shareholders.

Exxon is increasingly becoming an outlier in the industry. OGMP has emerged as the leading global standard for methane reporting and mitigation, with more than 100 member companies worldwide covering over 35% of global oil and gas production, over 70% of liquified natural gas flows and nearly 25% of global natural gas transmission and distribution pipelines. In the U.S. many of Exxon’s peers including ConocoPhillips, Oxy, EOG, Devon, and Pioneer have joined OGMP in the past 12 months.

The initiative is also broadly backed by the financial sector for its high-quality, standardized data which allow stakeholders to compare performance and thus effectively assess risks across operators. Support has come from Federated Hermes, Blackrock, Legal & General, and JP Morgan, as well as via comments to IFRS by investors representing $4 trillion, and through investor groups such as the $10 trillion Net Zero Asset Owner Alliance and IIGCC’s €60 trillion investor membership via their Oil and Gas Net Zero Standard.

A critical shareholder vote on May 31

A shareholder resolution scheduled for a vote on May 31 at Exxon’s Annual General Meeting provides an ideal opportunity for investors to express their support for the company to improve its methane measurement and mitigation protocols by joining OGMP.

As stated by shareholders supporting the resolution “ExxonMobil […] is better equipped to measure and mitigate methane emissions than almost any other company in the world.” The company has played a critical role in deploying and improving methane mitigation technology in the United States.

If Exxon wants to build credibility on climate, it’s time the company takes steps to show that its numbers can be trusted.