- Resources

- National oil companies and global finance: Unlocking opportunities to reduce methane emissions

Resources

National oil companies and global finance: Unlocking opportunities to reduce methane emissions

Published: May 28, 2025 by TJ Conway, RMI and Andrew Baxter, Environmental Defense Fund

In 2023, national oil companies (NOCs) made historic commitments to reduce methane emissions, signaling a critical step toward achieving global 2030 climate goals. This report seeks to understand the significance of NOCs, what drives their priorities and decision making, and how the finance sector can unlock the capital needed to help NOCs accelerate methane mitigation efforts, enabling the industry to accelerate near-term methane mitigation.

Report highlights

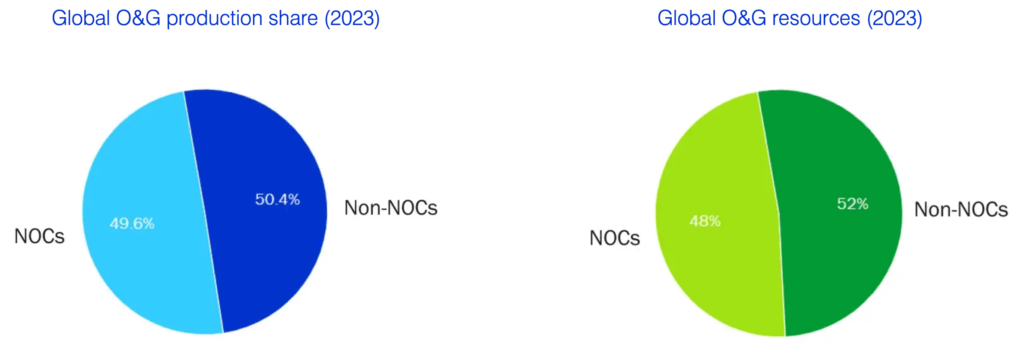

- NOCs are key to methane reduction: Representing half of global oil and gas production, NOCs must lead methane mitigation to achieve net-zero targets.

- NOCs are committing to climate action: Several NOCs, like Petronas and Ecopetrol, have set net-zero targets, responding to climate pressures and government priorities.

- Market and policy pressures are rising: Drivers such as EU methane laws and global LNG buyer preferences are incentivizing NOC methane management.

- Investors can drive climate action: Equity investors, asset managers, and insurers have significant influence on NOCs’ methane mitigation and decarbonization efforts.

- NOCs’ financial engagement creates opportunities: With many NOCs publicly traded and deeply involved in global capital markets, investors can influence their climate actions.

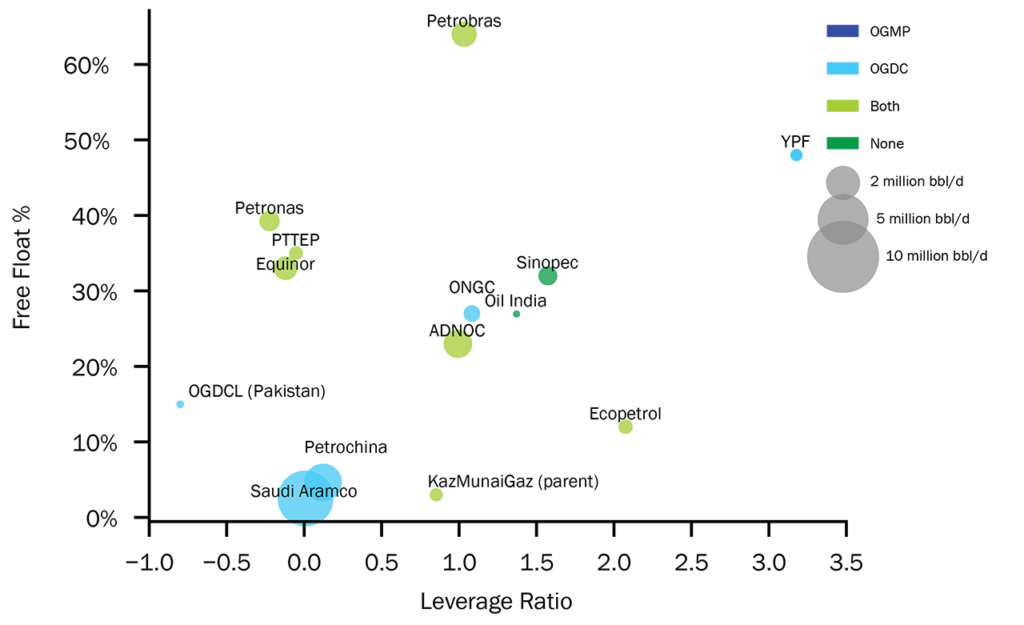

Analysis of major NOCs reveals financial engagement opportunities

- Methane reduction-linked debt is a key opportunity. NOCs rely on debt markets, and linking methane performance to debt terms offers a scalable mitigation solution.

- Equity investors can shape climate priorities. Even with majority government shares, private investors can influence NOCs to address methane.

- Financing by multi-lateral development banks can catalyze action. Institutions like the World Bank can support NOCs in launching methane mitigation projects, especially with technical aid.

- Joint venture partners and energy-importing countries have leverage. Oil and gas producer partnerships can lead to improved methane management.

- Leading NOCs can drive global change. Well-capitalized NOCs like Petronas and ADNOC can support lower-capacity NOCs with funding and technical support.

- Measurement, monitoring, reporting and verification practices are essential for progress. Reliable MMRV practices are key to holding companies accountable and ensuring results.

Production, market float and debt of selected National Oil Companies (2023)

NOCs & Global Finance: Unlocking Opportunities to Reduce Methane Emissions

Reaching global methane goals requires national oil companies to slash methane emissions. The finance sector can unlock progress.

-

Actionable insights for a decarbonizing worldLearn More