Transferred Emissions: How Risks in Oil and Gas M&A Could Hamper the Energy Transition

Transferred Emissions: How Risks in Oil and Gas M&A Could Hamper the Energy Transition

Transferred Emissions

The clock is ticking on climate action in the oil and gas industry. Reaching net zero by 2050 involves not only curtailing fossil fuel use but also limiting emissions from fossil fuel production as economies transition to a clean energy future.

A new report finds that oil and gas mergers and acquisitions, which may help industry majors execute their energy transition plans, does not help cut global greenhouse gas emissions. If assets move from industry leaders to industry laggards, emissions can increase and transparency can decrease, regardless of why M&A transactions take place.

Traditional oil and gas dealmaking – blind to the climate implications of asset transfer – may not be compatible with a net zero world that demands sustained and proactive climate stewardship.

In this report, we analyze the last five years of oil and gas M&A, tracking where assets moved and how this movement has impacted the planet.

Report Highlights

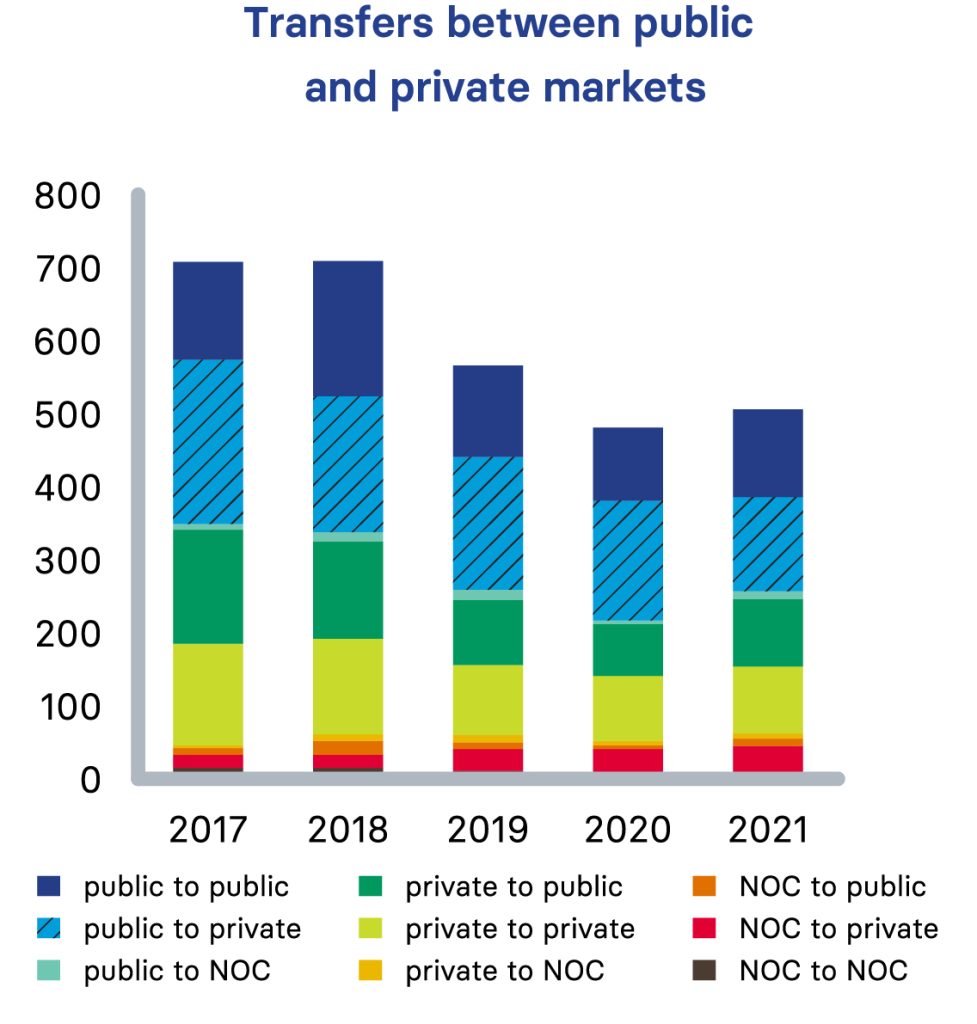

- Assets are flowing from public to private markets at a significant rate. Over the last five years, the number of public-to-private transfers exceeded the number of private-to-public transfers by 64%. In every year during this period public-to-private transfers comprised the largest share of deals.

- Assets are increasingly moving away from companies with environmental commitments. In 2018, deals that moved assets away from companies with environmental commitments accounted for only 10% of transactions. By 2021, these deals accounted for 15% of transactions.

- Stewardship risk in upstream oil and gas appears to be rising. The movement of upstream oil and gas facilities to private markets with traditionally less transparency and to companies with reduced environmental commitments suggests that a growing number of assets are at risk of weak climate stewardship.

Transferred Emissions Solutions

With coordinated action from asset managers, companies, banks, private equity firms, and civil society groups, stewardship risks from oil and gas M&A can be reduced.

- Institutional investors can ask oil and gas companies to disclose their annual emissions reduction stemming from asset transfer and encourage operators to incorporate climate safeguards in M&A deal terms.

- Buyers can commit to enhanced climate disclosure and best-in-class methane mitigation, flaring reduction, and well remediation.

- Companies selling assets can require prospective buyers to adhere to methane, flaring, and decommissioning practices.

- Banks can ensure that such climate standards are integrated in real transactions.