Financing Methane Abatement: An introduction to sustainable finance instruments

Financing Methane Abatement

An introduction to sustainable finance instruments

Creating the right financial instruments can enable cash-constrained national oil companies to pursue rapid oil and gas methane abatement.

The oil and gas industry is a major source of greenhouse gas emissions, including from methane leakage and flaring. National oil companies (NOCs) produce more than half the world’s oil and gas and are responsible for an even higher share of related methane emissions.

Some NOCs in lower-income countries face funding constraints that limit their ability to invest in methane abatement. As such, financial instruments that encourage NOC action on methane emissions can be powerful tools to fight climate change.

Methane abatement at NOCs presents a unique set of challenges, and designing instruments to meet them requires innovation incorporating four key ingredients: opportunity, due diligence, design and reporting.

This presentation and accompanying report by EDF and Rennaisouk introduce the major sustainable finance instruments and examine case studies of recent transactions across a range of instrument structures and goals – setting the stage for future work on the instruments that can best finance methane abatement at NOCs.

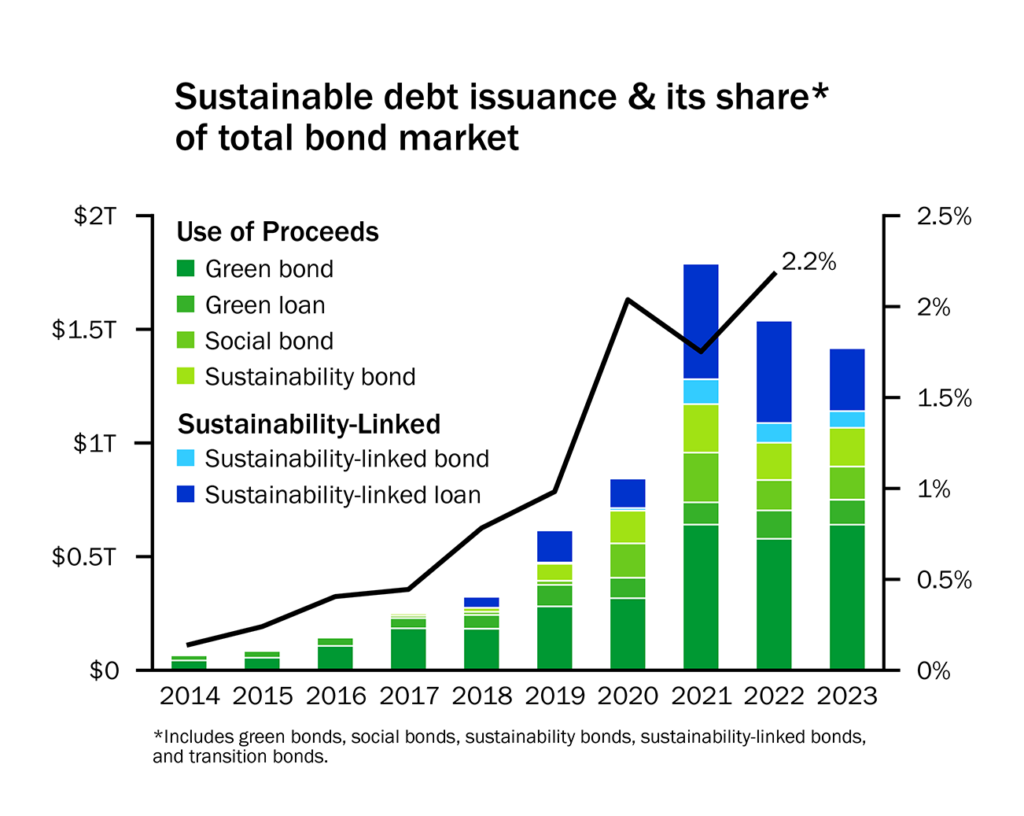

Sustainable debt is growing rapidly. Annual issuance of sustainable debt has grown 60x in the past decade, despite a slowdown in 2022-23, as more organizations seek to drive sustainability outcomes through financial links.

Leadership from issuers, facilitators and investors is needed to build and scale high-integrity financial mechanisms attuned to the requirements for methane abatement at resource-constrained NOCs.

Additional Resources

Blog

National Oil Companies’ Oversized and Overlooked Methane Emissions

Published November 28, 2023

Read More

Blog

State-owned oil companies lag on methane. Could the finance sector hold the key?

Published October 5, 2023

Read More

Report

Plugging the Leaks: An Investor Guide to Oil and Gas Methane Risk

Published March 6, 2023

Read More