The Inflation Reduction Act: A Snapshot for Business

Since publishing this resource, the IRA has undergone significant change. For the latest on climate policy and advocacy opportunities for businesses, visit our policy advocacy page and subscribe to our newsletter.

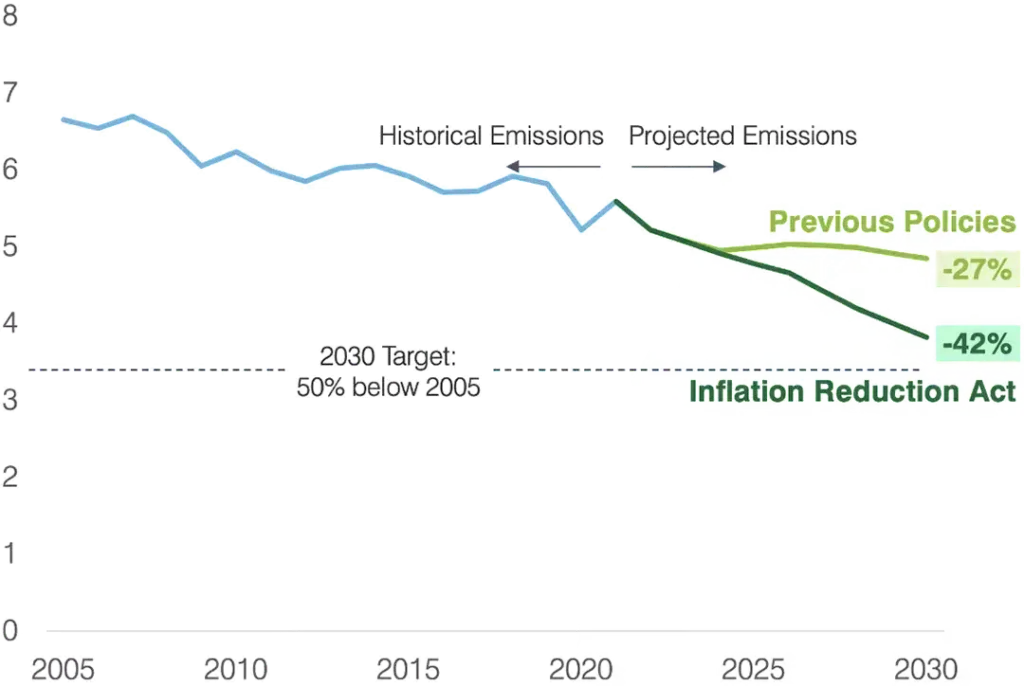

The Inflation Reduction Act (IRA) positions the US to cut greenhouse gas emissions by up to 42% by 2030, putting the target of 50% below 2005 levels within reach

Key Sectors for Abatement

Power

Acceleration of clean electricity from solar, wind, geothermal, and nuclear

Transportation

Deployment of electric and fuel cell vehicles, commercially and individually

Industry

Industrial efficiency upgrades and carbon capture

Buildings

Electrification and efficiency improvements in commercial and residential buildings

Agriculture & Land Use

Conservation and carbon sequestration in forest and agricultural lands

Net US Greenhouse Gas Emissions

(Billions metric tons CO2-equivalent)

Sources: Princeton REPEAT Project, New York Times, Deloitte Analysis

Businesses and community partners can act now to benefit from IRA incentives, many of which took effect in January 2023

How can I get started?

Identify relevant provisions

- Learn more about the credits, grants, and loans applicable to your organization

- Check eligibility criteria such as location and labor requirements

- Speak with external experts to validate research and fill in knowledge gaps

Engage stakeholders

- Connect with Finance, Procurement, Tax, and Government Relations to gain buy-in and build the business case

- Participate in Treasury and Executive Agencies’ RFIs to drive efficient, effective, and equitable IRA implementation

Move quickly

- Lock in domestic, low-emission suppliers to access IRA credit adders tied to geography, wages, apprenticeship, and more

- Start preparing now to be able to meet incentive caps for grant programs and capitalize on first mover advantages

With $369 billion in climate and clean energy investments, the IRA is the largest, most ambitious climate legislation ever passed by Congress

IRA Climate Spend by Category

based on Congressional Budget Office (CBO) Data

Sources: Deloitte Analysis, CBO, CPC Center, Credit Suisse

The Congressional Budget Office’s estimate of $369 billion is conservative. Others project over $800 billion in federal spending and up to $1.7 trillion in total spending including private-sector investment over the next decade.

Five sectors are likely to benefit most directly from the IRA’s climate-related provisions. Buyers and Producers in key abatement sectors may benefit from IRA credits, incentives, grants, and loans to advance their climate goals

Power

Sample Relevant Provisions

- Sec. 45/45Y: Renewable electricity production credit modification and extension

- Sec. 48/48E: Renewable energy investment credit modification and extension

Projected Sector Impact

- Accelerated renewable energy production

- Lowest levelized cost of clean electricity in world

- Cost competitiveness of green hydrogen with blue

- Increased nuclear power production

Producer Benefits

- Increase deployment of renewables such as solar and (offshore) wind (Sec. 45/45Y, 48/48E)

- Secure additional federal funding from adders for specific labor, location, and sourcing practices (Sec. 45/45Y, 48/48E)

- Secure domestic input material suppliers for wind and solar to mitigate supply chain bottlenecks

Buyer Benefits

- Shift portfolio of purchased electricity to renewable energy though PPAs, VPPAs, RECs, and/or green tariffs to lower costs and emissions

- Build decentralized, on-site energy systems that combine solar, wind, and battery storage to decrease price volatility, avoid outages, and sell excess back to grid (bundle Sec. 48/48E)

Transportation

Sample Relevant Provisions

- Sec. 45W: New commercial vehicle credit for electric and fuel cell vehicles

- Sec. 30C: Reinstated credit provides 30% tax credit for EV chargers (up to $100,000) in qualifying areas

Projected Sector Impact

- Accelerated EV adoption by several years as price parity with ICE approaches

- Decreased TCO for electric trucks, likely below that of diesel trucks for most light and medium duty truck usage cycles

Producer Benefits

- Utilize federal funding to accelerate domestic clean vehicle manufacturing, production, and assembly (incl. components) to become eligible for demand side incentives (Sec. 45X)

- Offer smart charging as a service to increase EV uptake and generate additional revenue (Sec. 30C)

Buyer Benefits

- Electrify commercial fleets, especially light and medium duty trucks to decrease costs and emissions (Sec. 45W)

- Install charging infrastructure to support EV fleet conversion (Sec. 30C)

- Convert to biofuels, SAF, and/or fuel cells where electrification is not feasible or viable

Industry

Sample Relevant Provisions

- Sec. 45X: Production credit for the manufacture of wind, solar, battery and electroconductive materials

- IRA Sec. 50161: Project-based grant funding for upgrading and retrofitting manufacturing plants to reduce emissions

Projected Sector Impact

- Boost in domestic production of key energy and EV components

- Improved economics for carbon capture and DAC

- Accelerated timeline for emerging clean tech in hard-to-abate sectors

Producer Benefits

- Utilize federal funding to expand domestic production of clean technology components to meet increased demand (e.g., solar, wind, battery, EV, hydrogen) (Sec. 45X)

- Utilize federal funding to upgrade or retrofit manufacturing facilities to decarbonize and electrify production (IRA Sec. 50161)

Buyer Benefits

- Source from domestic, low-emission suppliers to reduce indirect emissions and build supply chain resiliency

- Consider strategic alliances with suppliers (e.g., joint ventures) to benefit from domestic manufacturing incentives (Sec. 45X)

Buildings

Sample Relevant Provisions

- Sec. 179D: Enhanced deduction for energy efficiency improvements in commercial buildings

- Sec. 48/48E: Enhanced investment tax credit continues to support geothermal heat pumps and solar for commercial energy efficiency

Projected Sector Impact

- Significant expected increase in commercial building EE retrofits

- High expected demand for residential demand-side EE products incl. lighting, HVAC, and building envelope

Producer Benefits

- Source from green construction materials such as low carbon cement and steel, leveraging emissions labeling programs (IRA Sec. 60112, 60116)

- Integrate smart charging into building design to benefit from enhanced charging credit (Sec. 30C)

Buyer Benefits

- Improve energy efficiency through HVAC and lighting upgrades, heat pumps, hot water systems, or building envelope upgrades to qualify for up to $5/sq-ft. deduction or investment tax credit (Sec. 179D, 48/48E for heat pumps)

- Eliminate on-site fossil fuels and build decentralized, on-site energy systems (bundle Sec. 48/48E)

Agriculture & Land Use

Sample Relevant Provisions

- EQIP, ACEP, CSP and RCPP: Additional funding for working lands grant programs that help agricultural producers implement climate-smart agricultural practices

- IRA Sec. 22003: Funding for biofuel infrastructure and market expansion

Projected Sector Impact

- Advancement of climate-smart and organic farming and conservation practices

- Improved climate change adaptation and resilience of agricultural production

Producer Benefits

- Utilize federal funding to adopt climate-smart farming practices

- Increase renewables and electrification for farm operations/vehicles (REAP)

- Produce agricultural feedstocks for sustainable biofuels (provided no negative impact on land use) (Sec. 40, Sec. 45Z, IRA Sec. 22003)

Buyer Benefits

- Source agricultural inputs from suppliers using climate-smart practices, providing financial incentives where possible, to reduce upstream emissions

Sources: Deloitte Analysis, H.R.5376 – Inflation Reduction Act of 2022

Our Experts

Credit: Environmental Defense Fund and Deloitte

This document was produced by Environmental Defense Fund in collaboration with Deloitte Consulting LLP. The views within the report are that of Environmental Defense Fund, and do not necessarily reflect the views of report partners or collaborators.

This document contains general information only and Deloitte is not, by means of this document, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This document is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this document.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. Please see www.deloitte.com/about for a detailed description of DTTL and its member firms. Please see www.deloitte.com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries. Certain services may not be available to attest clients under the rules and regulations of public accounting.

Copyright © 2023 Deloitte Development LLC. All rights reserved. 36 USC 220506 Member of Deloitte Touche Tohmatsu Limited