Inflation Reduction Act Activation Guide: Renewable Energy Procurement

Renewable Energy Procurement

Inflation Reduction Act Activation Guide

Produced by EDF in collaboration with

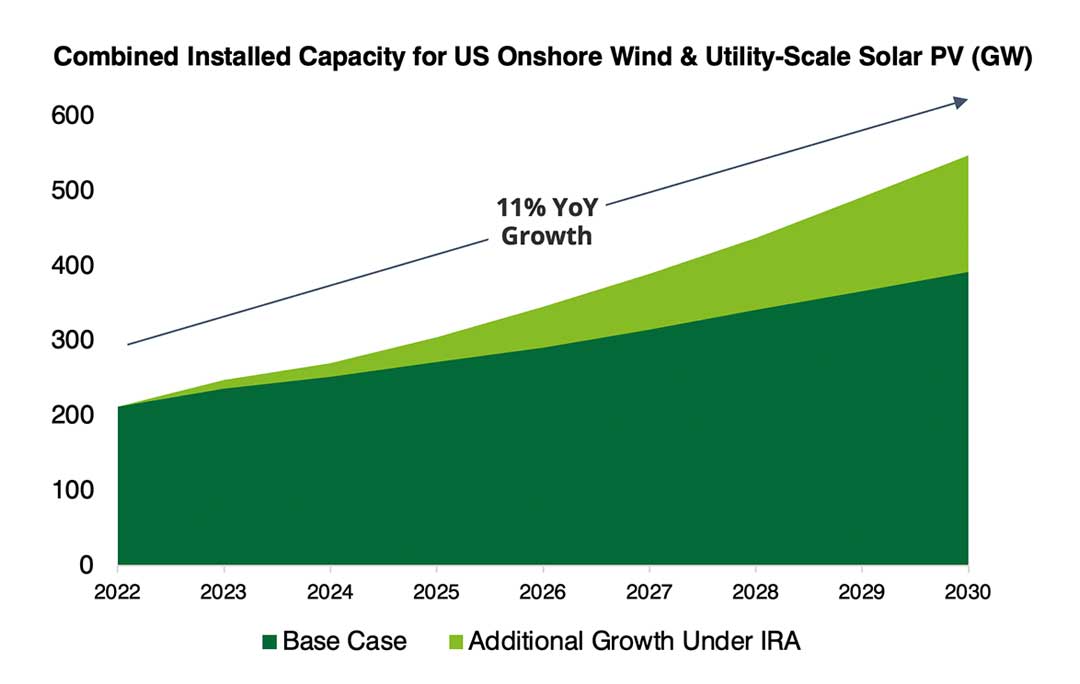

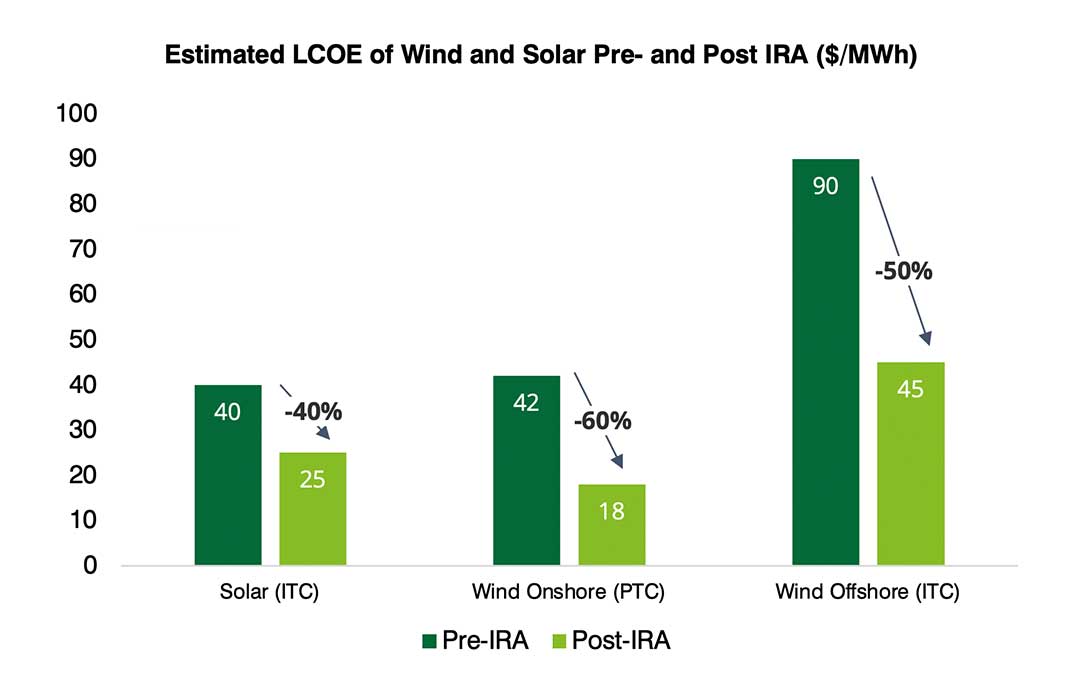

The IRA aims to increase supply of renewable energy in the US and is projected to lower clean energy costs in the long-term

Key Impacts

Notes: PTC stands for Production Tax Credit. ITC stands for investment tax credit. LCOE estimates assume projects earn $26/MWh PTC or 30% ITC.

Sources: Deloitte Analysis, H.R.5376 – Inflation Reduction Act of 2022, Princeton REPEAT Project, Credit Suisse, Goldman Sachs Research, Rystad Energy, EIA

Key Relevant Provisions

§45 and §48 are the key provisions to know for renewable energy, offering expanded production and investment tax credits to lower the costs and risks of renewables for companies

§45/§45Y: Renewable Energy Production Tax Credit (PTC)

Provision

Provides a 10-year tax credit of up to $27.50 per MWh for electricity generated by renewable energy resources and sold to unrelated party after facility is placed in service

Key Takeaways

- Covers electricity generated from wind, solar, landfill gas, biomass, geothermal and hydropower

- Replaced by technology neutral, emissions-based clean electricity generation credit §45Y starting in 2025, which phases out in 2032 or when U.S. electricity sector emissions are 75% below 2022 levels, whichever comes last

- Most viable for owners and developers of utility scale solar and wind renewable energy projects with solar expected to benefit the most

§48/§48E: Business Energy Investment Tax Credit (ITC)

Provision

Provides a tax credit of up to 30% of the upfront cost of a “qualifying energy property” such as a solar and wind electricity generation and standalone battery storage projects

Key Takeaways

- Covers a variety of renewable energy technologies such as solar, geothermal, wind, fuel cells, combined heat and power, and standalone storage, among others

- Modified and extended under IRA to include energy storage, qualified biogas, microgrid controllers, linear generators & dynamic/electrochromic glass, and interconnection property

- Similar to the PTC, this credit is replaced by clean electricity ITC §48E starting in 2025, available until 2032

- For companies, often most suitable for on-site electricity generation projects that do not intend to sell back to the grid

Notes: Unless otherwise specified, all references to “Section” in this presentation are to the Internal Revenue Code of 1986, as amended (IRC).

Sources: Deloitte Analysis, P.L. 117-119, WH IRA Guidebook, IRC.

With the support of the IRA, renewable energy procurement and generation can help organizations meet their business and climate goals

Key Opportunities for Business

While renewable energy costs may continue to rise temporarily in 2023 due to ongoing supply chain challenges, wind and solar will likely remain the cheapest energy sources in most areas of the US, as fuel costs for conventional generation have been rising faster than renewable costs.

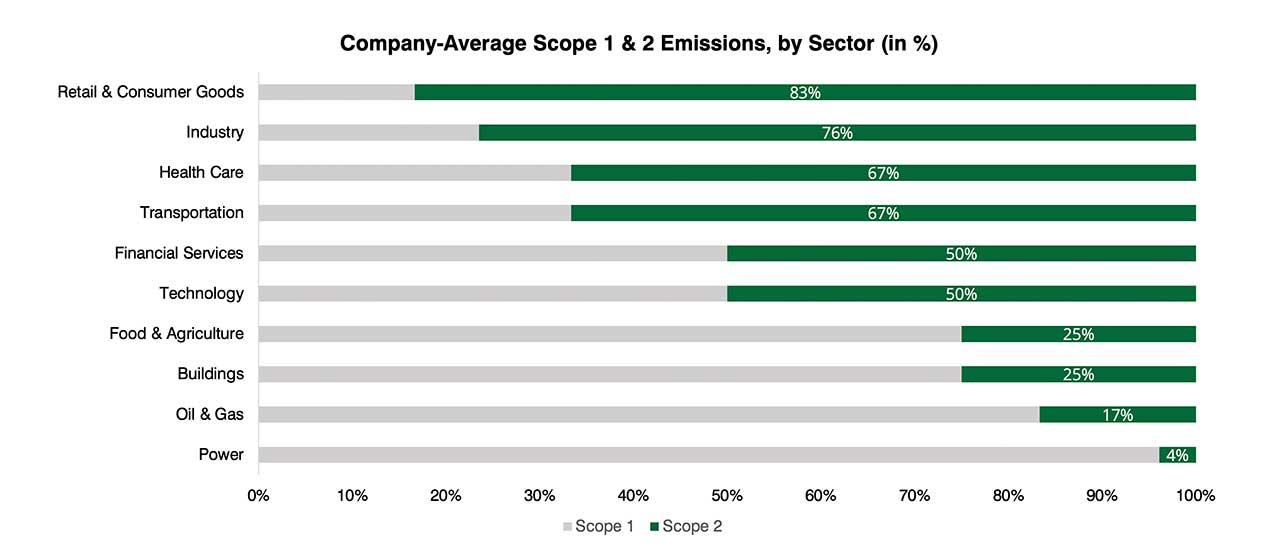

Renewable energy procurement and generation are among the most resource and time efficient strategies for companies to reduce their emissions. Creating and activating a renewables strategy should be an essential part of most organizations’ climate goals and abatement strategies.

Companies that choose to generate their own renewable energy and utilize on-site storage can generate tax credits on the qualifying property they own if they are either (1) utilizing the electricity themselves or (2) selling electricity back to the grid (48 & 45) . The IRA now allows these credits to be transferred by qualifying entities to third parties in exchange for cash.

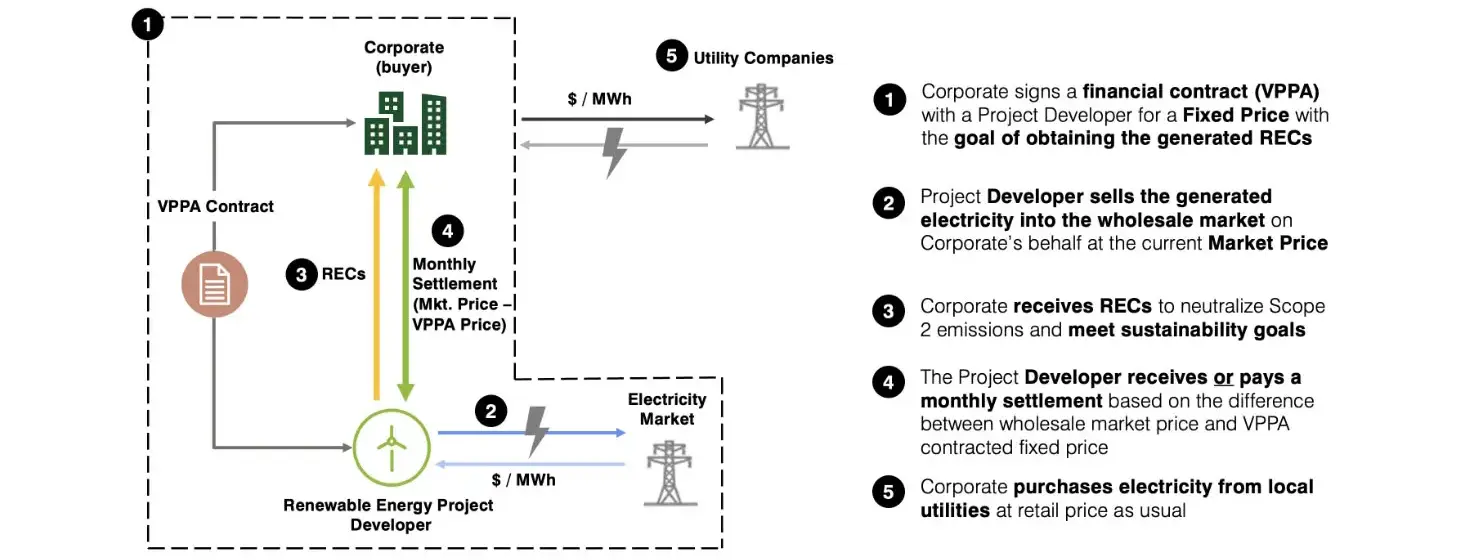

Power Purchase Agreements (PPAs) and Virtual Power Purchasing Agreements (VPPAs) allow companies to agree on a consistent long-term price of energy per MWh, which helps companies hedge against price volatility and improve certainty of long-term forecasting. For VPPAs, there is no physical delivery of energy, only the transfer of RECs associated with the energy generation.

On-site renewable energy and storage help companies improve the reliability and resiliency of their operations by mitigating the impacts of supply chain disruptions and power outages. Eligibility of energy storage assets for the investment tax credit is a new addition under the IRA (48).

Switching to clean sources of energy can help reduce air pollution and improve health outcomes, particularly for marginalized and disadvantaged communities. The IRA provides additional financial benefits for renewable energy deployed in such communities.

Notes: Unless otherwise noted, the number shown above refer to the respective Section of the Internal Revenue Code of 1986, as amended (IRC).

Sources: Deloitte Analysis, Deloitte 2023 Renewable Energy Industry Outlook, H.R.5376 – Inflation Reduction Act of 2022, Princeton REPEAT Project, Credit Suisse

The Climate Case

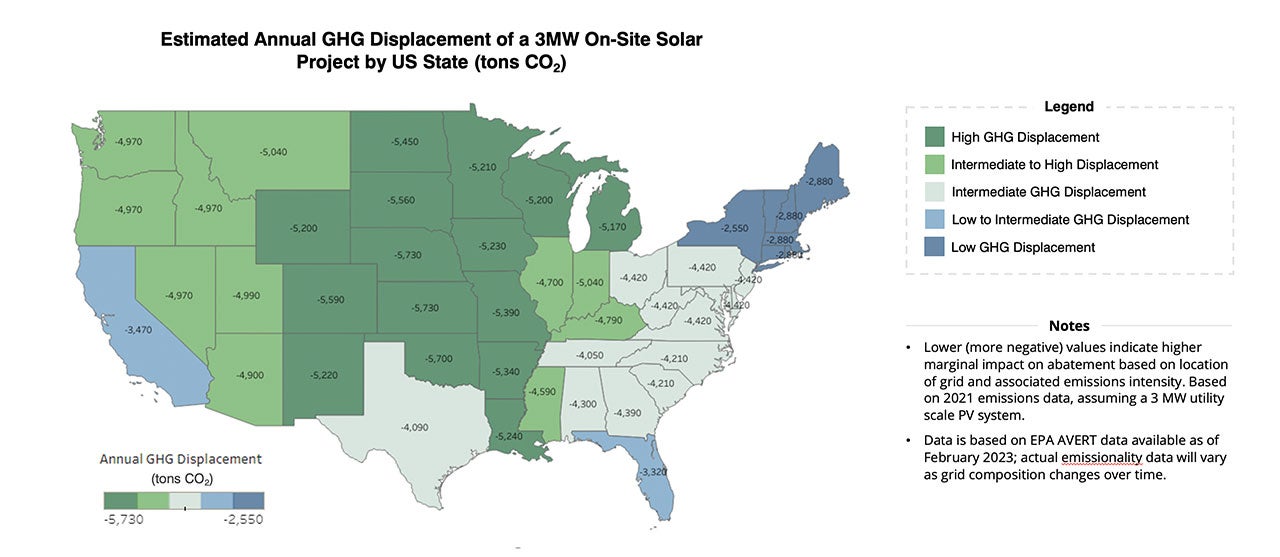

On-site renewable energy projects and VPPAs

with bundled RECs offset conventional generation capacity in the grid and reduce greenhouse gas emissions

Sources: Deloitte Analysis, EPA AVERT Web Edition

Organizations can take advantage of the IRA’s significant investment in renewable energy across the US by setting a renewables strategy and selecting optimal renewable energy options

| 1 | Establish an Overall Renewables Strategy To successfully procure renewable energy, an organization should first have a RE strategy that addresses key questions such as: |

|---|

What is the capacity to implement on-site generation to help meet its goals?

Are you willing to invest in a project with a low price but a risky profile, or would you prefer a higher price with less risk?

Are you most interested in hedging your future energy costs, or receiving RECs at the highest value possible?

How do the options fit in with the broader renewable energy strategy?

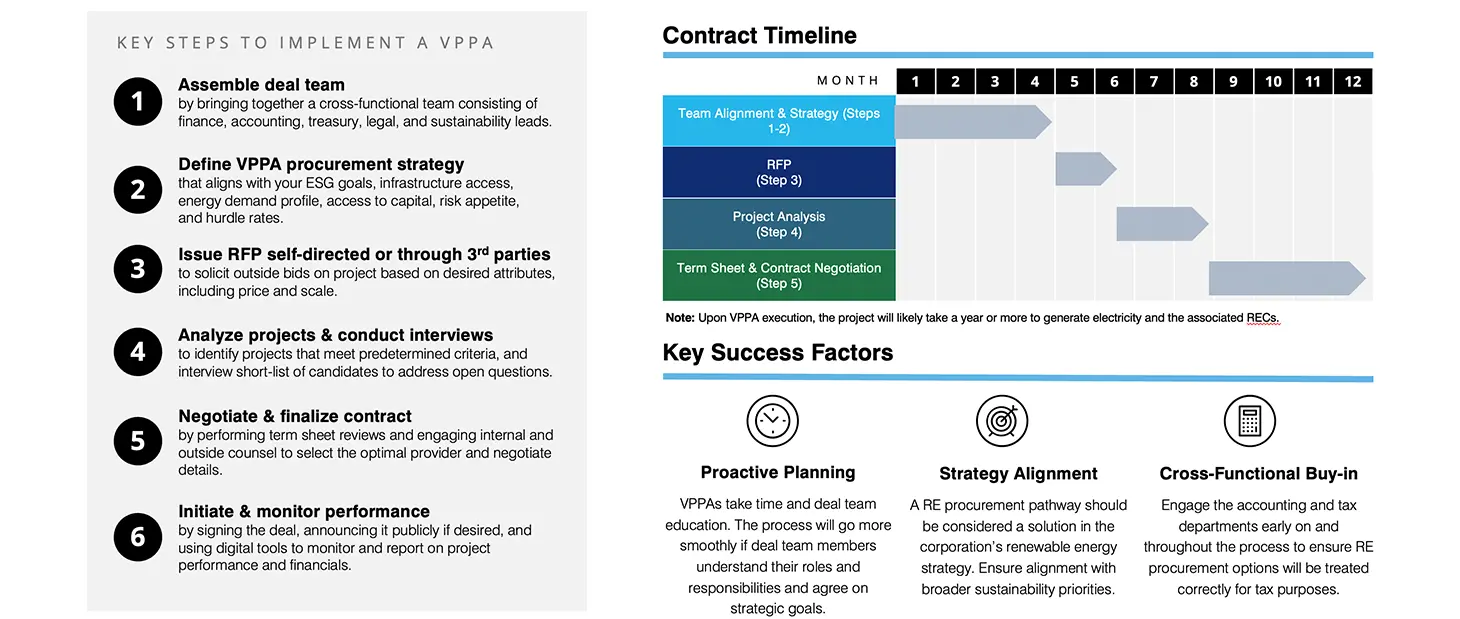

| 2 | Select the Optimal Renewable Energy Procurement Options |

|---|

1. Physical Power Purchases

Long-term contracts between RE generator and buyer that provide cost stability and predictability, with options for either on-site or off-site PPAs

2. On-site Generation

Adding on-site renewable energy to meet decarbonization goals and support renewables development (qualifies for direct IRA incentives)

3. Regulated Market Options

Green Tariffs or unbundled RECs that offer flexible options to purchase renewable energy and offset emissions

4. Virtual Power Purchase Agreements (VPPAs)

Long-term contract where RE generator and buyer agree on electricity settlement price, and buyer receives RECs generated by the project

Key Considerations

Corporate Strategy & Sustainability Goals

Access to Infrastructure

Current & Future Energy Demand

Access to Capital

Risk Appetite and ROI

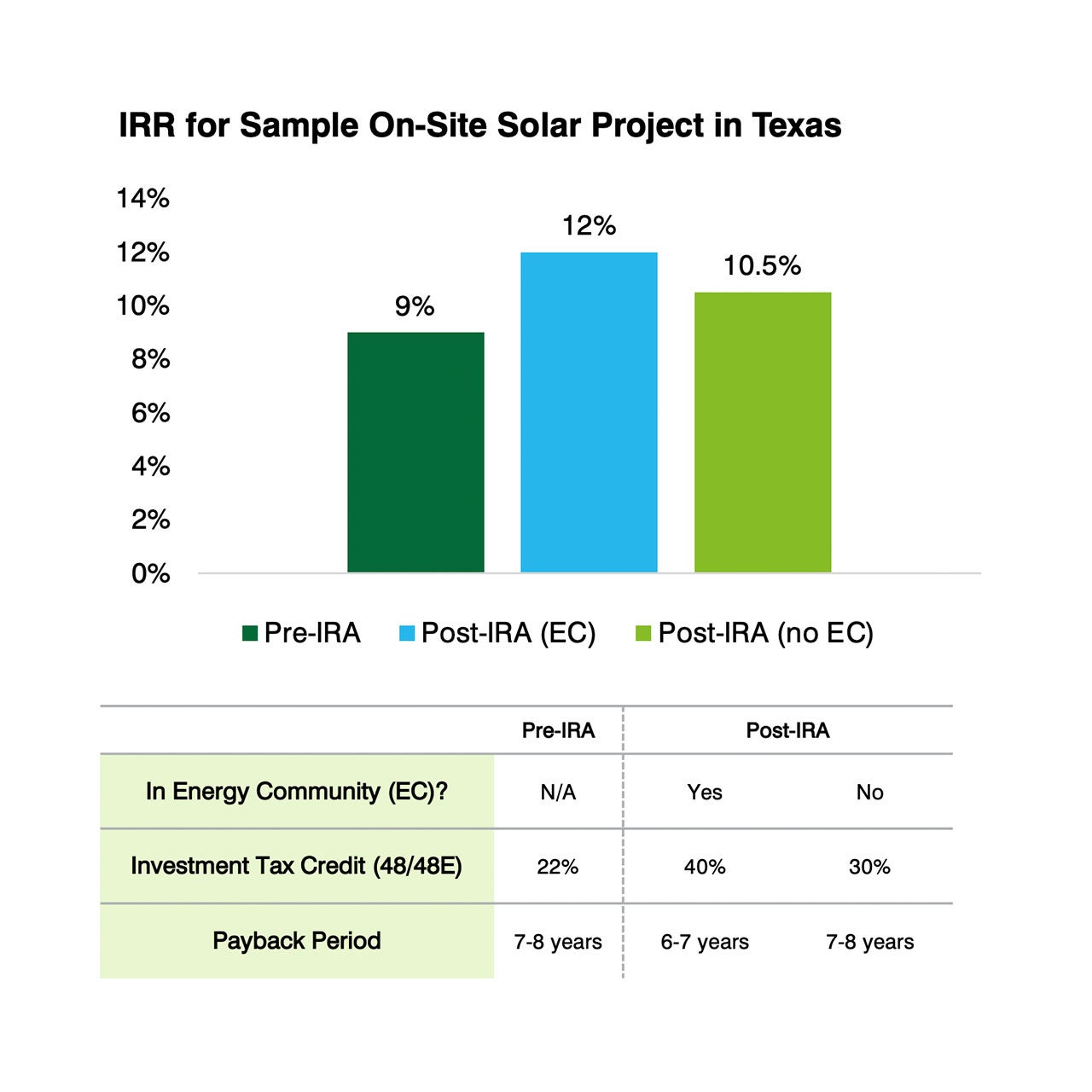

Business Case for On-Site Solar:

With a higher investment tax credit, on-site solar projects can generate higher IRRs

Sources: Deloitte Analysis, IRS, US DOL, Bipartisan Policy Center

Assumptions

- System size of 3,000 kW – DC

- Degradation of 0.5% per year

- Useful life of 17 years (model assumes a 17-year useful life, however, typical life of a solar system ranges from 30 to 40 years. Therefore, the NPV benefit under the own scenario would be higher if looking over the longer term.)

- Net capacity factor of 22.5%

- Cost to build of $2.10/watt

- All land is owned with no lease rate included

- Electricity rate of $0.095 per kWh with no price escalation

- Operating expenses $8.75 per kW with escalation of 2%

- Construction beginning in 2023 and commercial operation date in 2023

- Bonus depreciation of 80%

- Assumes project meets prevailing wage and apprenticeship requirements (impacts investment tax credit value)

- Financial result does not capture any avoided cost of not purchasing renewable energy credits and emission reductions nor does it capture the intrinsic value of the green marketing both internally and externally.

- Financial model contains simplified assumptions and market data available at the time when the analysis was performed in January 2023, which may affect its ability to reflect actual results; and where the model or elements of it relate to the future (such as projection/forecast of pricing, expected cost of technology, in service date and potential tax incentives), actual results are likely to be different from those produced by the model due to rapid changes in the market, and those differences may be material.

Definitions

- Prevailing wage refers to a minimum combination of basic hourly wage rate and any fringe benefits paid to laborers and mechanics

- Apprenticeship requirements include a specified percentage (e.g., 10-15%) of total labor hours reserved for qualified apprentices

- Energy communities are defined as brownfield sites, urban or non-urban areas with a certain unemployment rate, or former fossil fuel communities

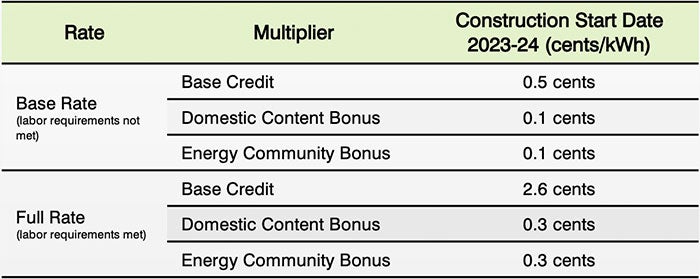

Credit Overview

- Provision Description: Provides a tax credit for production of electricity from renewable sources

- Period of Availability: Projects beginning construction before 1/1/25

- Incentive Type: Production tax credit

- New or Modified Provision: Modified and extended. Extended for projects beginning construction before 1/1/25. Modified to tie value of credit to meeting prevailing wage and apprenticeship requirements.

Credit Amount

Eligibility Requirements

Organization Types and Usage:

- Businesses that own or develop renewable energy projects

- Tax-exempt entities that fall under subtitle F of the IRC, Indian Tribal governments, rural electricity co-ops among others that own or develop renewable energy projects

Project Types:

Electricity generation from wind, solar, biomass, geothermal, small irrigation, landfill and trash, hydropower, and marine and hydrokinetic sources

Construction Start Date:

Construction start date dictates eligibility for PTC and rate; however, PTC is claimed in the tax year that the facility is placed in service (see IRS Guidance on construction start date)

Example project types (non-exhaustive):

- On-and Offshore Wind

- Solar

- Biomass

- Geothermal

- Hydropower

How to Claim the Credit

- Fill out and file IRS Form 8835 or IRS Form 3800 to claim the PTC

- Review the initial IRS guidance on prevailing wage and apprenticeship requirements

- Look up additional information regarding the PTC in the Database of State Incentives for Renewables & Efficiency (DSIRE)

Sources: Deloitte Analysis, H.R.5376 – Inflation Reduction Act of 2022, WH IRA Guidebook, DoE Solar Energy Technologies Office, IRC.

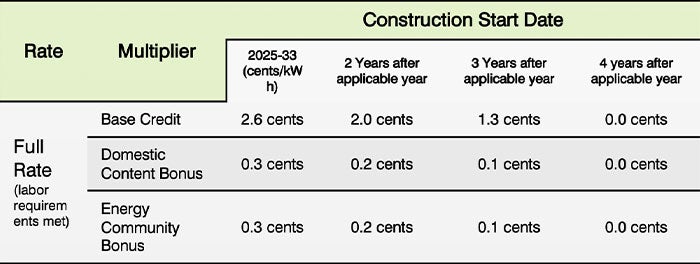

Credit Overview

- Provision Description: Provides a technology-neutral tax credit for production of clean electricity. Replaces the PTC for electricity generated from renewable sources which is available until 12/31/24.

- Period of Availability: Facilities placed in service after 12/31/24. Phase-out starts the later of a) 2032 or b) when U.S. GHG emissions from electricity are 25% of 2022 emissions or lower.

- Incentive Type: Production tax credit

- New or Modified Provision: New

Credit Amount (only full rate shown below)

Eligibility Requirements

Organization Types and Usage:

- Businesses that own or develop renewable energy projects

- Tax-exempt entities that fall under subtitle F of the IRC, Indian Tribal governments, rural electricity co-ops among others that own or develop renewable energy projects

Project Types:

Applies to generation facilities that have an anticipated GHG emissions rate of zero

Construction Start Date & Phase-Out:

- Construction start date dictates eligibility for PTC and rate; however, PTC is claimed in the tax year that the facility is placed in service (see IRS Guidance on construction start date)

- The credit will be phased out as the U.S. meets its GHG emissions reduction targets. (Facilities can claim 100% of credit in the first year after reaching the target, 75% in Year 2, 50% in Year 3, and 0% in Year 4)

Available for facilities placed in service between January 1, 2025 and likely 2032 and beyond

How to Claim the Credit

- Fill out and file IRS Form 8835 or IRS Form 3800 to claim the PTC

- Review the initial IRS guidance on prevailing wage and apprenticeship requirements to assess opportunities for credit adders

- Look up additional information regarding the PTC in the Database of State Incentives for Renewables & Efficiency (DSIRE)

Notes: The term “applicable year” is defined as the later of a) 2032 or b) the year the Treasury determines that the electric power sector emits 75% less carbon than 2022 levels.

Sources: Deloitte Analysis, H.R.5376 – Inflation Reduction Act of 2022, WH IRA Guidebook, DoE Solar Energy Technologies Office, IRC.

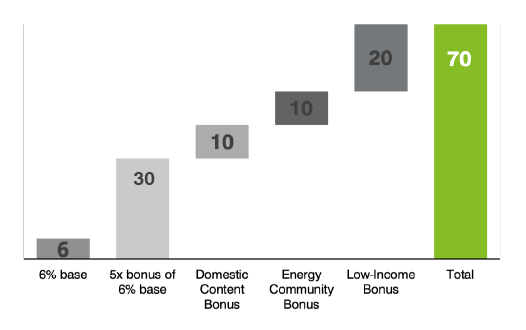

Credit Overview

- Provision Description: Provides a tax credit for investment in renewable energy projects

- Period of Availability: Projects beginning construction before 1/1/25

- Incentive Type: Investment tax credit

- New or Modified Provision: Modified and extended to include standalone energy storage with capacity of at least 5 kWh, biogas, microgrid controllers (20MW or less), and interconnection property for projects with 5MW or less

Credit Amount (in % of investment cost):

- Prevailing Wage & Apprenticeship Bonus qualifies projects for 5x bonus multiplier times the base

- Domestic content bonus provides additional 10 ppt

- Energy community bonus and low-income bonus provide an additional 10 ppt and 20 ppt credit, respectively

Eligibility Requirements

Organization Types and Usage:

- Businesses that own or develop renewable energy projects

- Tax-exempt entities that fall under subtitle F of the IRC, Indian Tribal governments, rural electricity co-ops among others that own or develop renewable energy projects

Project Types:

Fuel cell, solar, geothermal, small wind, standalone energy storage, biogas, microgrid controllers, and combined heat and power properties. It includes solar powered heating and cooling as well as equipment that uses solar energy to illuminate the inside of a structure using fiber-optic distributed sunlight or electrochromic glass

Example project types (non-exhaustive):

- Fuel Cell

- Solar

- Energy Storage

- Wind

- Biogas

- Geothermal

Available for construction start dates between January 1, 2023 and December 31, 2024

How to Claim the Credit

- Fill out and file IRS Form 3468 or IRS Form 3800 to claim the ITC

- Review the initial IRS guidance on prevailing wage and apprenticeship requirements and the Environmental Justice Solar and Wind Capacity Limitation to assess opportunities for credit adders

- Review additional information regarding the ITC which can be found online using the Database of State Incentives for Renewables & Efficiency (DSIRE)

Sources: Deloitte Analysis, P.L. 117-119, WH IRA Guidebook, IRC.

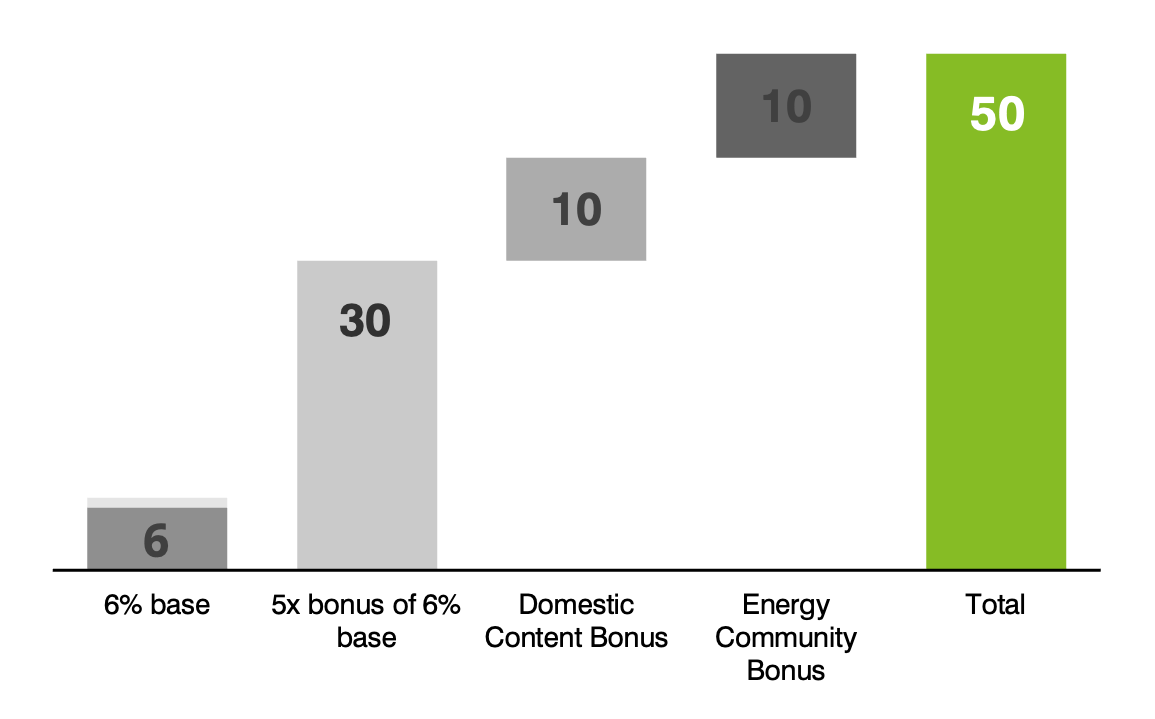

Credit Overview

- Provision Description: Provides a technology-neutral tax credit for investment in facilities that generate clean electricity. Replaces the ITC for facilities generating electricity from renewable sources

- Period of Availability: Facilities placed in service after 12/31/24. Phase-out starts the later of a) 2032 or b) when U.S. GHG emissions from electricity are 25% of 2022 emissions or lower

- Incentive Type: Investment tax credit

- New or Modified Provision: New

Credit Amount (in % of investment cost):

- Prevailing Wage & Apprenticeship Bonus qualifies projects for 5x bonus multiplier times the base

- Domestic content bonus provides additional 10 ppt

- Energy community bonus provide an additional 10 ppt credit

Eligibility Requirements

Organization Types and Usage:

- Businesses that own or develop renewable energy projects

- Tax-exempt entities that fall under subtitle F of the IRC, Indian Tribal governments, rural electricity co-ops among others that own or develop renewable energy projects

Project Types:

Facilities that generate electricity with a GHG emissions rate that is no greater than zero and qualified energy storage technologies

Construction Start Date & Phase-Out:

- Construction start date dictates eligibility for ITC. However, ITC is claimed in the tax year that the facility is placed in service (IRS Guidance on construction start date)

- The credit will be phased out as the U.S. meets its GHG emissions reduction targets. (Facilities can claim 100% of credit in the first year after reaching the target, 75% in Year 2, 50% in Year 3, and 0% in Year 4)

Available for facilities placed in service between January 1, 2025 and likely 2032 and beyond

How to Claim the Credit

- Fill out and file IRS Form 3468 or IRS Form 3800 to claim the ITC

- Review the initial IRS guidance on prevailing wage and apprenticeship requirements to assess opportunities for credit adders

- Review additional information regarding the ITC which can be found online using the Database of State Incentives for Renewables & Efficiency (DSIRE)

Sources: Deloitte Analysis, P.L. 117-119, WH IRA Guidebook, IRC.

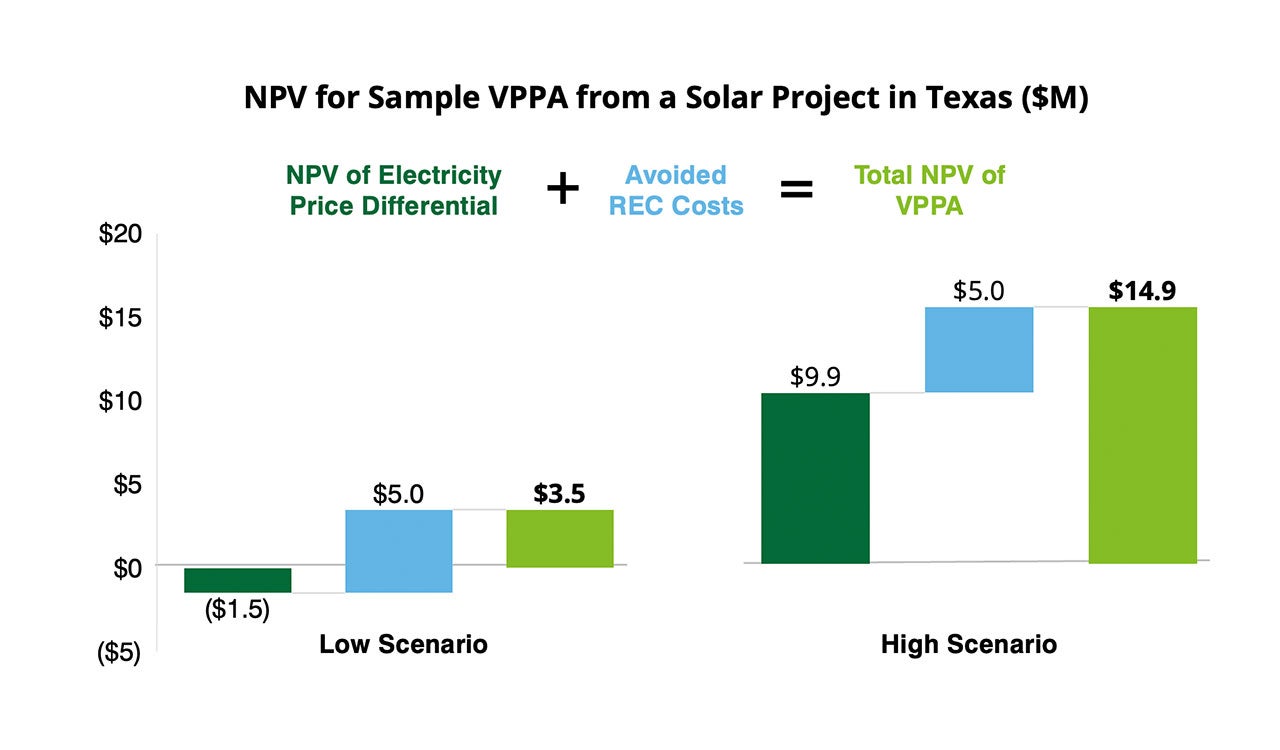

Business Case for VPPA:

Despite short term supply chain challenges, the clean electricity credits in the IRA are expected to increase the financial attractiveness of VPPAs

Notes: REC stands for Renewable Energy Credit, which is a market-based instrument that represents the property rights to the environmental, social, and non-power attributes of 1 MWh of renewable electricity generation. SEIA stands for Solar Energy Industries Association.

Sources: Deloitte Analysis, EPA

VPPA Pricing Trends

- Long-Term Supply Boost: The IRA will provide significant support for long-term renewable buildout

- Short-Term Supply Chain Snags: In the short-term, renewables capacity and pricing are hampered by lengthy interconnection queue backlogs, supply chain obstacles, permitting challenges, and ongoing inflationary pressures driving rising costs across inputs

- 2024+ Impact: SEIA expects the real impact of the IRA on renewables to come to fruition by 2024, with a forecasted 21% average annual capacity growth across all solar segments from 2023-2027

- High Competition: Competition for PPA prices will continue to put timing pressure on buyers to execute contracts in the near term

Assumptions

- Procurement amount per year: 100,000 MWh

- Project location: ERCOT (Texas)

- Commercial Operation Date (“COD”): Q1 2026

- Contract term: 15 years

- Fixed PPA price: $40.0/MWh

- Discount rate: 6%

- Projected REC cost: $5/MWh

- Projected Settlement Value Range: -$1.51/MWh to $10.16/MWh

- REC Avoided Cost: Calculated as the present value of the savings of not purchasing RECs on the open market throughout the contract term

- The above analysis is illustrative based upon market conditions as of January 2023 and the key assumptions provided. The financial results of an actual RFP can differ based upon the requirements of the RFP and the market conditions at that time.

VPPA Spotlight

Sources: Deloitte Analysis

Corporate demand for renewable energy is growing rapidly and can be met through various creative models and partnerships

Notes: All information on this slide has been obtained from publicly available sources (e.g., press releases) and shall not be construed to reflect companies’ tax attributes or actual usage of tax credits.

Sources: Solar Holler, ENEL North America, Holcim, Whirpool, AES, NextEra Energy Partners

Every function has a role to play to take advantage of the IRA’s renewable energy opportunities

- Refresh overall renewables strategy based on projected impacts of IRA incentives

- Align renewables and IRA strategy with overall corporate strategy

- Refresh overall renewables strategy based on projected impacts of IRA incentives

- Calculate projected abatement potential from renewables options and compare against goals, strategy, and alternative abatement projects

- Conduct ROI analysis of VPPA vs. PPA vs. on-site renewables options based on IRA incentives and projected market impacts (e.g., PTC vs. ITC financial modeling analysis)

- Optimize ownership structure for renewables projects in line with strategic goals and tax planning considerations post-IRA

- Assess eligibility for credit adders based on census tract definitions of low-income and rural communities and calculate projected value

- Optimize tax credit choice (§45 vs. §48) based on projected project costs and capacity factor

- Prepare to file for relevant incentives (e.g., IRS Form 3468)

- Work with Tax to identify suitable and eligible geographic locations for on-site generation

- Identify suitable VPPA/PPA partner

- Collect and track data on prevailing wage and apprenticeship requirements where the company is developing the project

- Identify additional federal, state and local incentive structures

- Track additional IRS Guidance on the energy generation incentives (while the comment period for the energy generation credits closed on November 4, 2022, the IRS continues to release additional guidance)

Credit: Environmental Defense Fund and Deloitte

This document was produced by Environmental Defense Fund in collaboration with Deloitte Consulting LLP. The views within the report are that of Environmental Defense Fund, and do not necessarily reflect the views of report partners or collaborators.This document contains general information only and Deloitte is not, by means of this document, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This document is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this document.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. Please see www.deloitte.com/about for a detailed description of DTTL and its member firms. Please see www.deloitte.com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries. Certain services may not be available to attest clients under the rules and regulations of public accounting.Copyright © 2023 Deloitte Development LLC. All rights reserved. 36 USC 220506 Member of Deloitte Touche Tohmatsu Limited

Our Experts

Victoria Mills

Managing Director

Environmental Defense Fund

vmills@edf.org

Andrea Pereira

Climate Policy & Outreach

Environmental Defense Fund

apereira@edf.org

Sign up for Climate Policy News you can use

"*" indicates required fields