The quest for cleaner gas: Engaging the ecosystem

The Quest for Cleaner Gas: Engaging the Ecosystem

Natural gas buyers have strong influence over supply chains, but have yet to expand contract terms to include emissions intensity. Investor engagement with segments of the industry can influence the market toward lower-emissions gas.

Natural Gas Emissions

Methane is firmly on the international climate agenda, and more than 100 countries have adopted the Global Methane Pledge, a collective agreement to cut methane emissions by at least 30 percent below 2020 levels by 2030. The energy sector — including oil, natural gas, coal, and bioenergy—accounts for nearly 40 percent of anthropogenic (human-caused) methane emissions.

- Natural gas producers are increasingly focused on reducing upstream emissions, but other players in the global gas trade are far less engaged on the issue.

- Natural gas deal terms still center on price, volume, and delivery. Expanding gas supply contract terms to include emissions intensity could broaden engagement and accelerate progress on emissions reduction.

- Equity and credit investors, commercial banks, export credit agencies, and trade insurance companies all play a role in gas project finance and ongoing lending to gas players. By introducing methane into the conversation, these players can create incentives for operators to do more.

This brief incorporates insights and language from three reports published by the Center for Strategic and International Studies (CSIS), supported by Environmental Defense Fund.

Global Gas Ecosystem

The structure of the global gas market has important implications that affect how investors can engage to affect methane emissions:

- Most gas never crosses a border. In 2020, two-thirds of the world’s gas was consumed in the country where it was produced. The remaining one third crossed a border by pipeline or on a ship as LNG.

- A few trade corridors are key. Most pipeline trade revolves around Europe or takes place within North America. Most LNG ends up in Asia, either from the Asia-Pacific region or from the Middle East. Significant strides can be made by focusing investor attention on a few key markets.

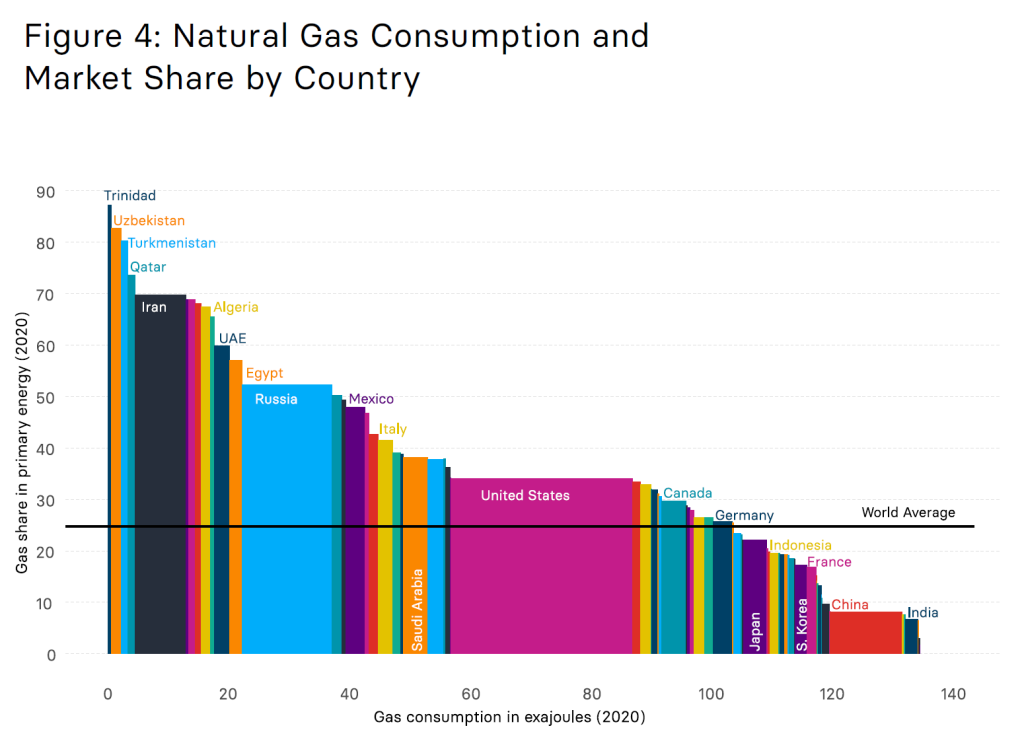

- The share of gas in an economy affects its market and policy positions. A gas buyer that is heavily reliant on natural gas might have fewer developed alternatives and thus could be more risk-averse to any policies that might disrupt energy supply.

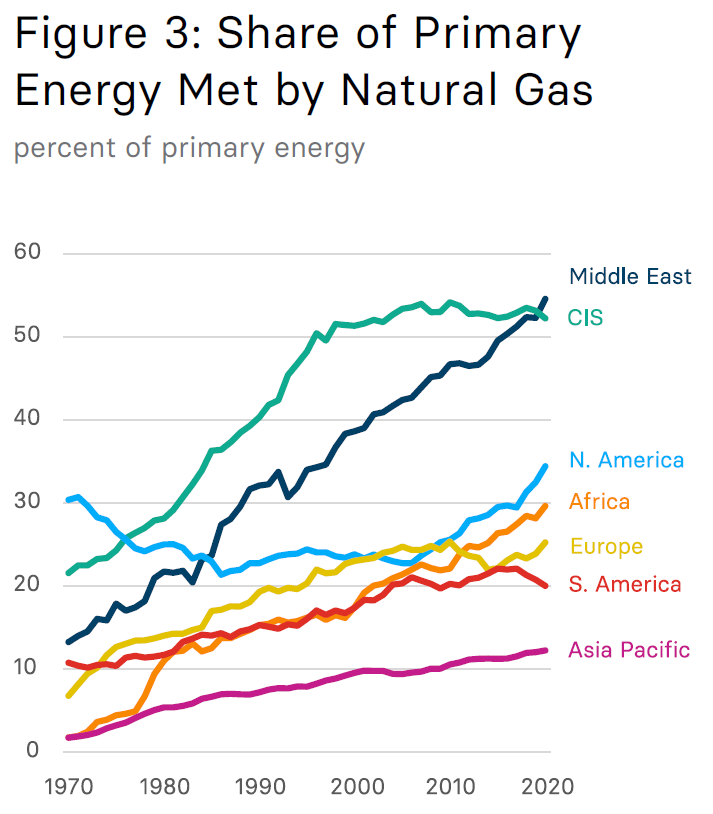

- Almost a quarter of the world’s energy came from natural gas in 2020, a share that has risen steadily over the past 50 years. Regions that depend most on gas are the Commonwealth of Independent States (CIS) and the Middle East, where gas accounted for over half of primary energy in 2020. It is critical that investors take the emissions footprint of this fuel into account.

- Transparency surrounding emissions within gas markets has been lacking. However, there is a growing consensus in industry that emissions data quality must improve to gain stakeholder confidence. Companies representing over a third of global oil and gas production have joined the Oil and Gas Methane Partnership.

Supply Chain Scrutiny

Some global gas players have robust targets to cut methane emissions, but others have no discernible plans. Stakeholder pressure matters and in the absence of a regulatory framework it can promote voluntary efforts that mobilize gas players to proactively cut methane emissions across the supply chain.

- Generally, the supermajors are more supportive of tougher methane regulations than smaller oil and gas companies that face less investor scrutiny on methane. Investor pressure continues to be a powerful incentive for these companies to increase the quality of their emissions data, the comprehensiveness of their reporting, and focus on emission reductions.

- National oil companies are ultimately accountable to governments, whether they are wholly state-owned or partly listed. Many NOCs have exposure to international capital markets – particularly credit markets — and international investors can challenge them to adopt more ambitious climate goals.

- Some LNG exporters and gas producers are marketing low-emission-intensity gas, or “differentiated” gas. The scope and rigor of emissions tracking remains an open question, especially in light of the near-universal lack of measurement-based methane emissions data.

- Trading houses such as Vitol, Trafigura, Mercuria, and Gunvor have become significant players in global LNG trade, buying and selling cargoes around the world. But some commodity traders are privately held, and their public commitments on methane emissions are scarce.

- Gas and power utilities in gas-importing countries typically set the terms of long-term natural gas contracts and invest in producing-country LNG projects that present levers for engagement on emissions. To date, gas and power utilities have generally not shared much information on their methane intensity goals. Investor and stakeholder pressure is critical.